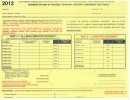

2008 Business Return Of Tangible Property And Machinery & Tools -Spotsylvania County Page 4

ADVERTISEMENT

WHEN DO I FILE?

To avoid a late filing penalty of 10%, this form must be postmarked on or before February 1, 2008.

WHAT IF I NEED MORE TIME TO FILE?

An extension may be requested for thirty (30), sixty (60), or ninety (90) days. The request must be filed

with our office on or before February 1, 2008. A confirmation will be sent to you via letter, email or fax.

A copy of the extension request form can be accessed on our website at

WHEN WILL I RECEIVE A BILL?

th

Tax bills are mailed twice a year, approximately 30 days prior to the due dates of June 5

and

th

December 5

. If you do not receive a bill, please contact the Treasurer’s Office at 540-507-7058 or

view your account balance at https://

WHAT IS THE TAX RATE?

Tax Rate per $100 of

Tax Class

Assessed Value

Furniture & Fixtures

$5.00

Heavy Construction Equipment

$2.00

Machinery & Tools

$2.50

WHAT HAPPENED TO THE VEHICLES?

If you have business vehicles, you should receive a separate filing form for reporting changes. Please

do not use this form to report licensed motor vehicles, trailers, boats or aircraft. If you do not receive a

return for vehicles, please call 540-507-7052 or email

cor@spotsylvania.va.us

with any questions.

_________________________________________________________________________________

Contact information

Office: Attn: Business Property, Commissioner of Revenue

Mailing Address:

PO Box 175, Spotsylvania VA 22553

Overnight Address:

9104 Courthouse Rd, Spotsylvania VA 22553

Hours:

Monday – Friday / 8:00 am to 4:30 pm

Phone:

540-507-7051

Fax:

540-582-7421

Email:

cor@spotsylvania.va.us

Do you have comments about our new form or instructions? We want to hear from you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4