Business Return Of Tangible Property And Machinery & Tools Spotsylvania County Form - 2007 (Expired)

ADVERTISEMENT

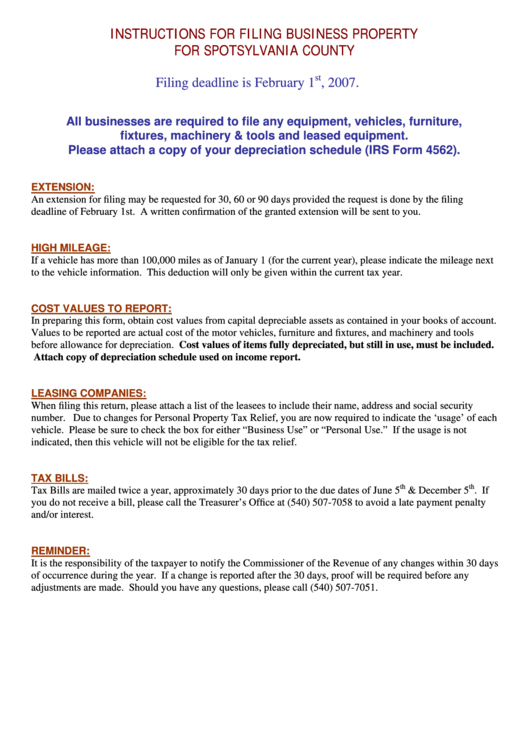

INSTRUCTIONS FOR FILING BUSINESS PROPERTY

FOR SPOTSYLVANIA COUNTY

st

Filing deadline is February 1

, 2007.

All businesses are required to file any equipment, vehicles, furniture,

fixtures, machinery & tools and leased equipment.

Please attach a copy of your depreciation schedule (IRS Form 4562).

EXTENSION:

An extension for filing may be requested for 30, 60 or 90 days provided the request is done by the filing

deadline of February 1st. A written confirmation of the granted extension will be sent to you.

HIGH MILEAGE:

If a vehicle has more than 100,000 miles as of January 1 (for the current year), please indicate the mileage next

to the vehicle information. This deduction will only be given within the current tax year.

COST VALUES TO REPORT:

In preparing this form, obtain cost values from capital depreciable assets as contained in your books of account.

Values to be reported are actual cost of the motor vehicles, furniture and fixtures, and machinery and tools

before allowance for depreciation. Cost values of items fully depreciated, but still in use, must be included.

Attach copy of depreciation schedule used on income report.

LEASING COMPANIES:

When filing this return, please attach a list of the leasees to include their name, address and social security

number. Due to changes for Personal Property Tax Relief, you are now required to indicate the ‘usage’ of each

vehicle. Please be sure to check the box for either “Business Use” or “Personal Use.” If the usage is not

indicated, then this vehicle will not be eligible for the tax relief.

TAX BILLS:

th

th

Tax Bills are mailed twice a year, approximately 30 days prior to the due dates of June 5

& December 5

. If

you do not receive a bill, please call the Treasurer’s Office at (540) 507-7058 to avoid a late payment penalty

and/or interest.

REMINDER:

It is the responsibility of the taxpayer to notify the Commissioner of the Revenue of any changes within 30 days

of occurrence during the year. If a change is reported after the 30 days, proof will be required before any

adjustments are made. Should you have any questions, please call (540) 507-7051.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4