Surety Bond Transmittal Form - State Of New Mexico Department Of Workforce Solutions

ADVERTISEMENT

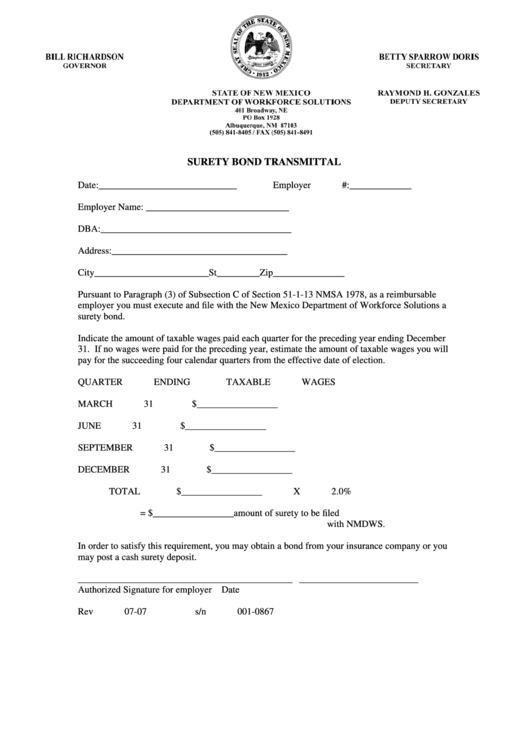

SURETY BOND TRANSMITTAL

Date:_____________________________

Employer #:_____________

Employer Name: ______________________________

DBA:________________________________________

Address:_____________________________________

City________________________St_________Zip_______________

Pursuant to Paragraph (3) of Subsection C of Section 51-1-13 NMSA 1978, as a reimbursable

employer you must execute and file with the New Mexico Department of Workforce Solutions a

surety bond.

Indicate the amount of taxable wages paid each quarter for the preceding year ending December

31. If no wages were paid for the preceding year, estimate the amount of taxable wages you will

pay for the succeeding four calendar quarters from the effective date of election.

QUARTER ENDING

TAXABLE WAGES

MARCH 31

$_________________

JUNE 31

$_________________

SEPTEMBER 31

$_________________

DECEMBER 31

$_________________

TOTAL

$_________________ X 2.0%

=

$_________________amount of surety to be filed

with NMDWS.

In order to satisfy this requirement, you may obtain a bond from your insurance company or you

may post a cash surety deposit.

_____________________________________________

_________________________

Authorized Signature for employer

Date

Rev 07-07

s/n 001-0867

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1