Utility Users Tax (Uut) Refund Claim Form

ADVERTISEMENT

City of Long Beach

RETURN TO:

Utility Users Tax (UUT) Refund Claim Form

City of Long Beach

Attn: City Treasurer

th

333 W. Ocean Blvd., 6

Floor

Business

Residential

Long Beach, CA 90802

Name (please print)

Service Address

Mailing Address

_____________________________________________________________________________

Phone Number

(

)

List the utility companies that you are claiming a Utility User Tax refund (use additional forms if necessary):

Company Name

Company Name

Account Number

Account Number

Company Name

Company Name

Account Number

Account Number

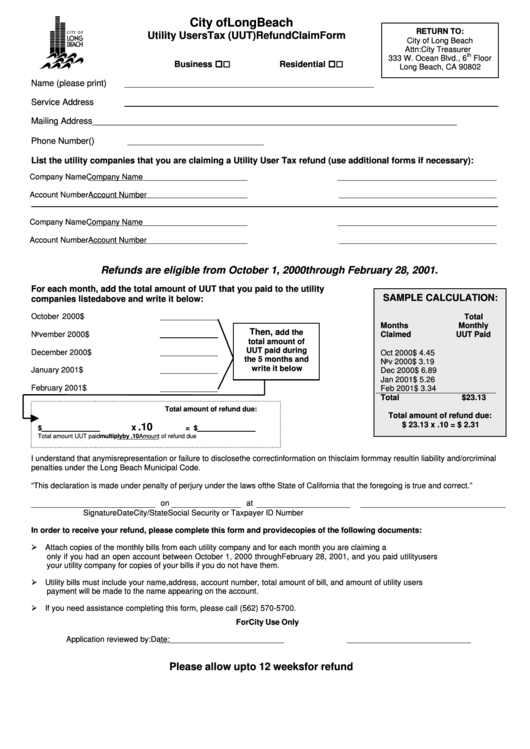

Refunds are eligible from October 1, 2000 through February 28, 2001.

For each month, add the total amount of UUT that you paid to the utility

SAMPLE CALCULATION:

companies listed above and write it below:

October 2000

$

Total

Months

Monthly

Then, a

dd the

November 2000

$

Claimed

UUT Paid

total amount of

UUT paid during

December 2000

$

Oct 2000

$ 4.45

the 5 months and

Nov 2000

$ 3.19

write it below

January 2001

$

Dec 2000

$ 6.89

Jan 2001

$ 5.26

February 2001

$

Feb 2001

$ 3.34

Total

$23.13

Total amount of refund due:

Total amount of refund due:

$ 23.13 x .10 = $ 2.31

.10

x

$

= $

Total amount UUT paid

multiply by .10

Amount of refund due

I understand that any misrepresentation or failure to disclose the correct information on this claim form may result in liability and/or criminal

penalties under the Long Beach Municipal Code.

“This declaration is made under penalty of perjury under the laws of the State of California that the foregoing is true and correct.”

on

at

Signature

Date

City/State

Social Security or Taxpayer ID Number

In order to receive your refund, please complete this form and provide copies of the following documents:

Attach copies of the monthly bills from each utility company and for each month you are claiming a refund. You will qualify for a refund

only if you had an open account between October 1, 2000 through February 28, 2001, and you paid utility users tax. Please contact

your utility company for copies of your bills if you do not have them.

Utility bills must include your name, address, account number, total amount of bill, and amount of utility users tax charged. The refund

payment will be made to the name appearing on the account.

If you need assistance completing this form, please call (562) 570-5700.

For City Use Only

Application reviewed by:

Date:

Please allow up to 12 weeks for refund

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1