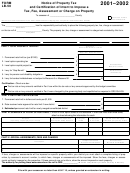

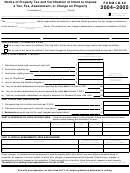

Instructions For Form Lb-50 - Notice Of Property Tax And Certification Of Intent To Impose A Tax, Fee, Assessment Or Charge On Property Page 3

ADVERTISEMENT

List the specific charge(s) on the available line(s)

Submission to assessor

under the heading, “Description.”

If you are imposing a tax on property, you must

Describe the tax, i.e., ad valorem, sewer assessment,

submit the following documents to the county as-

or specific unit of measurement. Determine the total

sessor in each county in which this tax is imposed

of each type of charge. Place the total dollar figure

by July 15, or the date of extension granted by the

in the appropriate category.

assessor:

Attach a complete listing of properties, by assessor’s

• Two copies of the resolution statements that adopt

account number, to which fees, charges, and assess-

the budget, make appropriations, levy taxes, and

ments are imposed. Show the amount of the fees,

categorize the taxes.

charges, or assessments which are imposed uni-

• Two copies of a complete LB-50.

formly on the properties, i.e., each property will pay

• Copies of any newly approved local option or

the same dollar amount. If the fees, charges, or as-

permanent rate ballot measures.

sessments are not uniform, i.e., the amounts are cal-

The assessor may request additional documents.

culated differently for each property, show the

amount imposed on each property.

A complete copy of your budget must be submit-

ted to the county clerk by September 30.

If your district is using Part IV, you must enter the

ORS number that gives the district the authority to

place the items on the tax roll in the space provided.

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4