Instructions For Form Lb-50 - Notice Of Property Tax And Certification Of Intent To Impose A Tax, Fee, Assessment Or Charge On Property Page 4

ADVERTISEMENT

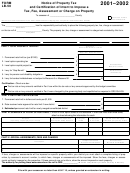

Form LB-50 Sample

2001–2002

Notice of Property Tax

FORM

LB-50

and Certification of Intent to Impose a

Tax, Fee, Assessment or Charge on Property

Sample

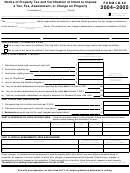

To assessor of ______________________ County

Check here if this is

an amended form.

• Be sure to read instructions in the 2001–2002 Notice of Property Tax Levy Forms and Instructions booklet.

City of Illustration

The __________________________ has the responsibility and authority to place the following property tax, fee, charge or assessment

District Name

Sample

on the tax roll of ______________________ County. The property tax, fee, charge or assessment is categorized as stated by this form.

County Name

123 Main Street

Illustration

OR

97000

Mailing Address of District

City

State

ZIP

A. Test

Mayor

(503) 378-0000

6-29-01

Contact Person

Title

Daytime Telephone

Date

Enter rate or

Subject to

PART I: TOTAL PROPERTY TAX LEVY

amount. Carry

General Government Limits

rate out four

Rate –or– Dollar Amount

decimal places.

1.7000

1. Permanent rate limit tax (per $1000)

1

5,000

Amounts and

2. Local option operating tax

2

rates entered in

Excluded from

.7510

3. Local option capital project tax

3

Measure 5 Limits

boxes 1–6

0

must be the

4. Levy for “Gap Bonds”

4

Dollar Amount

same as what

of Bond Levy

0

is in the

5. Levy for pension and disability obligations

5

resolution.

$

5,656

6. Levy for bonded indebtedness not subject to Measure 5 or Measure 50

6

Certification—Check one box.

X

Must be a

The tax rate or levy amounts certified in Part I are within the tax rate or levy amounts approved by the budget committee.

dollar amount.

The tax rate or levy amounts certified in Part I were changed by the governing body and republished as required in ORS 294.435.

PART II: RATE LIMIT CERTIFICATION

Must check

box indicating

1.7000

7. Permanent rate limit in dollars and cents per $1,000

7

the tax is within

N/A

the rate or

8. Date received voter approval for rate limit if new district

8

amount

N/A

9. Estimated permanent rate limit for newly merged/consolidated district

9

approved or

box indicating

PART III: SCHEDULE OF LOCAL OPTION TAXES — Enter all local option taxes on this schedule. If there are more than three taxes,

budget was

attach a sheet showing the information for each.

republished.

Purpose

Date voters approved

First year

Final year

Tax amount per year –or–

(operating, capital project, or mixed)

local option ballot measure

levied

to be levied

rate authorized by voters

Operating

Nov. 2, 1999

2000

2002

$

5,000

Must be

completed if

Capital project

May 18, 1999

1999

2006

$

0.7510

you have local

option tax

authority.

PART IV: SPECIAL ASSESSMENTS, FEES AND CHARGES

Subject to General

Excluded from

Description

Government Limitation

Measure 5 Limitation

$ 10,000

Delinquent Sewer Charges

1

2

If fees, charges or assessments will be imposed on specific property within your district you must attach a complete listing of prop-

erties, by assessor’s account number, to which fees, charges or assessments will be imposed. Show the fees, charges or assess-

ments uniformly imposed on the properties. If these amounts are not uniform, show the amount imposed on each property.

Complete this

224.400

The authority for putting these assessments on the roll is ORS _____________.

(Must be completed if you have an entry in Part IV.)

line only if

there is an

150-504-050 (Rev. 12-00)

amount in

File with your assessor no later than JULY 15, unless granted an extension in writing.

Part IV.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4