Form Dte 106c - Certificate Of Reduction For Homestead Exemption

ADVERTISEMENT

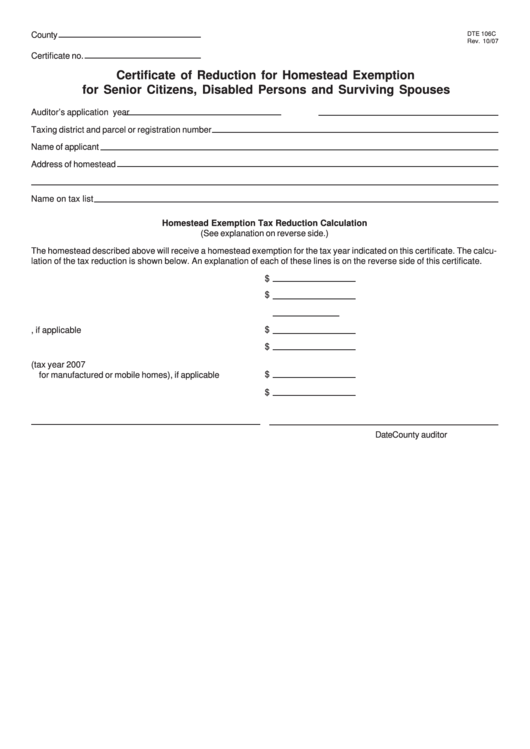

DTE 106C

County

Rev. 10/07

Certificate no.

Certificate of Reduction for Homestead Exemption

for Senior Citizens, Disabled Persons and Surviving Spouses

Auditor’s application no.

Tax year

Taxing district and parcel or registration number

Name of applicant

Address of homestead

Name on tax list

Homestead Exemption Tax Reduction Calculation

(See explanation on reverse side.)

The homestead described above will receive a homestead exemption for the tax year indicated on this certificate. The calcu-

lation of the tax reduction is shown below. An explanation of each of these lines is on the reverse side of this certificate.

1.Taxable value of the homestead before reduction

$

$

2.Taxable value eligible for homestead exemption

3.Tax rate for the current year

mills

$

4.Adjustment for other tax credits, if applicable

$

5.Calculated homestead reduction for current year

6.Homestead reduction for tax year 2006 (tax year 2007

$

for manufactured or mobile homes), if applicable

7.Homestead reduction credit for current year

$

County auditor

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2