Form 990 - Installment Agreement

Download a blank fillable Form 990 - Installment Agreement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 990 - Installment Agreement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Click on (i) for instructions

Reset Form

Print

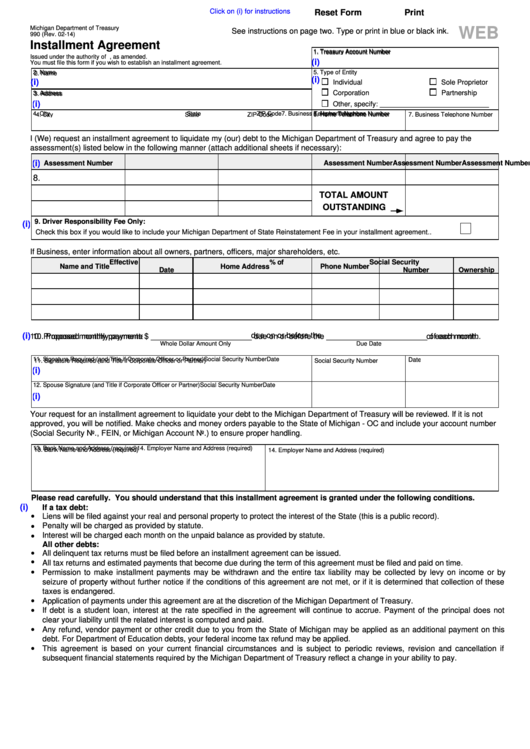

Michigan Department of Treasury

WEB

See instructions on page two. Type or print in blue or black ink.

990 (Rev. 02-14)

Installment Agreement

1. Treasury Account Number

1. Treasury Account Number

Issued under the authority of P.A. 122 of 1941, as amended.

(i)

You must file this form if you wish to establish an installment agreement.

2. Name

5. Type of Entity

2. Name

(i)

(i)

Individual

Sole Proprietor

Corporation

Partnership

3. Address

3. Address

(i)

Other, specify: ____________________________

4. City

State

ZIP Code

6. Home Telephone Number

7. Business Telephone Number

6. Home Telephone Number

7. Business Telephone Number

4. City

State

ZIP Code

I (We) request an installment agreement to liquidate my (our) debt to the Michigan Department of Treasury and agree to pay the

assessment(s) listed below in the following manner (attach additional sheets if necessary):

(i)

Assessment Number

Assessment Number

Assessment Number

Assessment Number

Assessment Number

Assessment Number

8.

TOTAL AMOUNT

OUTSTANDING

9. Driver Responsibility Fee Only:

(i)

Check this box if you would like to include your Michigan Department of State Reinstatement Fee in your installment agreement.................

If Business, enter information about all owners, partners, officers, major shareholders, etc.

Effective

Social Security

% of

Name and Title

Home Address

Phone Number

Date

Number

Ownership

due on or before the

(i)

10. Proposed monthly payments $ _______________________ due on or before the _______________________ of each month.

10. Proposed monthly payments $

of each month.

Whole Dollar Amount Only

Due Date

11. Signature Required (and Title if Corporate Officer or Partner)

Social Security Number

Date

Date

11. Signature Required (and Title if Corporate Officer or Partner)

Social Security Number

(i)

12. Spouse Signature (and Title if Corporate Officer or Partner)

Social Security Number

Date

(i)

Your request for an installment agreement to liquidate your debt to the Michigan Department of Treasury will be reviewed. If it is not

approved, you will be notified. Make checks and money orders payable to the State of Michigan - OC and include your account number

(Social Security No., FEIN, or Michigan Account No.) to ensure proper handling.

13. Bank Name and Address (required)

14. Employer Name and Address (required)

13. Bank Name and Address (required)

14. Employer Name and Address (required)

Please read carefully. You should understand that this installment agreement is granted under the following conditions.

(i)

If a tax debt:

Liens will be filed against your real and personal property to protect the interest of the State (this is a public record).

Penalty will be charged as provided by statute.

Interest will be charged each month on the unpaid balance as provided by statute.

All other debts:

All delinquent tax returns must be filed before an installment agreement can be issued.

All tax returns and estimated payments that become due during the term of this agreement must be filed and paid on time.

Permission to make installment payments may be withdrawn and the entire tax liability may be collected by levy on income or by

seizure of property without further notice if the conditions of this agreement are not met, or if it is determined that collection of these

taxes is endangered.

Application of payments under this agreement are at the discretion of the Michigan Department of Treasury.

If debt is a student loan, interest at the rate specified in the agreement will continue to accrue. Payment of the principal does not

clear your liability until the related interest is computed and paid.

Any refund, vendor payment or other credit due to you from the State of Michigan may be applied as an additional payment on this

debt. For Department of Education debts, your federal income tax refund may be applied.

This agreement is based on your current financial circumstances and is subject to periodic reviews, revision and cancellation if

subsequent financial statements required by the Michigan Department of Treasury reflect a change in your ability to pay.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3