Exemption Crtificate Form - State Of Arkansas - Department Of Finance And Administration - Sales And Use Tax Section - 1997

ADVERTISEMENT

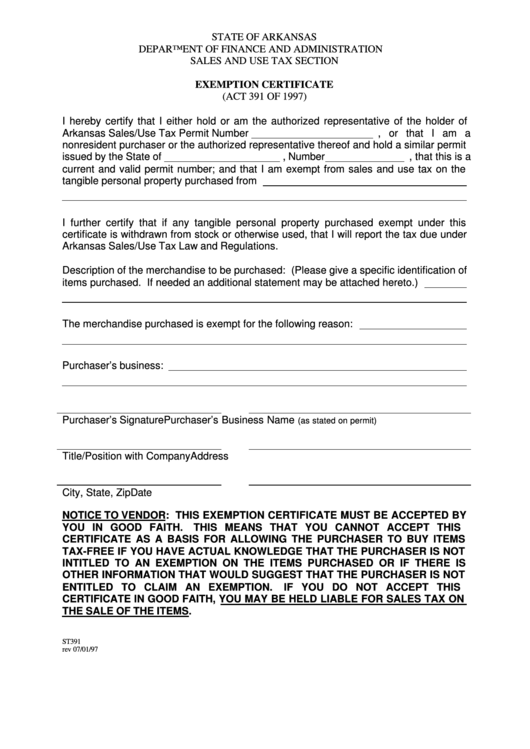

STATE OF ARKANSAS

DEPARTMENT OF FINANCE AND ADMINISTRATION

SALES AND USE TAX SECTION

EXEMPTION CERTIFICATE

(ACT 391 OF 1997)

I hereby certify that I either hold or am the authorized representative of the holder of

Arkansas Sales/Use Tax Permit Number

, or that I am a

nonresident purchaser or the authorized representative thereof and hold a similar permit

issued by the State of

, Number

, that this is a

current and valid permit number; and that I am exempt from sales and use tax on the

tangible personal property purchased from

I further certify that if any tangible personal property purchased exempt under this

certificate is withdrawn from stock or otherwise used, that I will report the tax due under

Arkansas Sales/Use Tax Law and Regulations.

Description of the merchandise to be purchased: (Please give a specific identification of

items purchased. If needed an additional statement may be attached hereto.)

The merchandise purchased is exempt for the following reason:

Purchaser’s business:

Purchaser’s Signature

Purchaser’s Business Name

(as stated on permit)

Title/Position with Company

Address

City, State, Zip

Date

NOTICE TO VENDOR: THIS EXEMPTION CERTIFICATE MUST BE ACCEPTED BY

YOU IN GOOD FAITH.

THIS MEANS THAT YOU CANNOT ACCEPT THIS

CERTIFICATE AS A BASIS FOR ALLOWING THE PURCHASER TO BUY ITEMS

TAX-FREE IF YOU HAVE ACTUAL KNOWLEDGE THAT THE PURCHASER IS NOT

INTITLED TO AN EXEMPTION ON THE ITEMS PURCHASED OR IF THERE IS

OTHER INFORMATION THAT WOULD SUGGEST THAT THE PURCHASER IS NOT

ENTITLED TO CLAIM AN EXEMPTION.

IF YOU DO NOT ACCEPT THIS

CERTIFICATE IN GOOD FAITH, YOU MAY BE HELD LIABLE FOR SALES TAX ON

THE SALE OF THE ITEMS.

ST391

rev 07/01/97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1