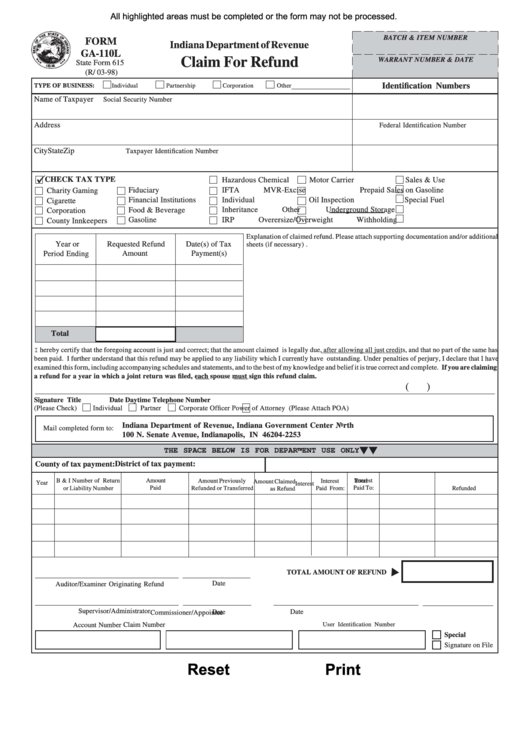

All highlighted areas must be completed or the form may not be processed.

BATCH & ITEM NUMBER

FORM

Indiana Department of Revenue

GA-110L

Claim For Refund

WARRANT NUMBER & DATE

State Form 615

(R/ 03-98)

Identification Numbers

TYPE OF BUSINESS:

Individual

Partnership

Corporation

Other

Name of Taxpayer

Social Security Number

Address

Federal Identification Number

City

State

Zip

Taxpayer Identification Number

!

CHECK TAX TYPE

Hazardous Chemical

Motor Carrier

Sales & Use

IFTA

MVR-Excise

Prepaid Sales on Gasoline

Fiduciary

Charity Gaming

Individual

Oil Inspection

Special Fuel

Financial Institutions

Cigarette

Food & Beverage

Inheritance

Other

Underground Storage

Corporation

Gasoline

IRP

Overersize/Overweight

Withholding

County Innkeepers

Explanation of claimed refund. Please attach supporting documentation and/or additional

Year or

Requested Refund

Date(s) of Tax

sheets (if necessary) .

Amount

Payment(s)

Period Ending

Total

I hereby certify that the foregoing account is just and correct; that the amount claimed is legally due, after allowing all just credits, and that no part of the same has

been paid. I further understand that this refund may be applied to any liability which I currently have outstanding. Under penalties of perjury, I declare that I have

examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief it is true correct and complete. If you are claiming

a refund for a year in which a joint return was filed, each spouse must sign this refund claim.

(

)

Signature

Title

Date

Daytime Telephone Number

(Please Check)

Individual

Partner

Corporate Officer

Power of Attorney (Please Attach POA)

Indiana Department of Revenue, Indiana Government Center North

Mail completed form to:

100 N. Senate Avenue, Indianapolis, IN 46204-2253

THE SPACE BELOW IS FOR DEPARTMENT USE ONLY

District of tax payment:

County of tax payment:

Interest

B & I Number of Return

Amount

Amount Previously

Interest

Total

Amount Claimed

Year

Interest

Paid To:

or Liability Number

Paid

Refunded or Transferred

Paid From:

Refunded

as Refund

TOTAL AMOUNT OF REFUND

Date

Auditor/Examiner Originating Refund

Supervisor/Administrator

Date

Date

Commissioner/Appointee

Account Number

Claim Number

User Identification Number

Special

Signature on File

Reset

Print

1

1