(

)

(

)

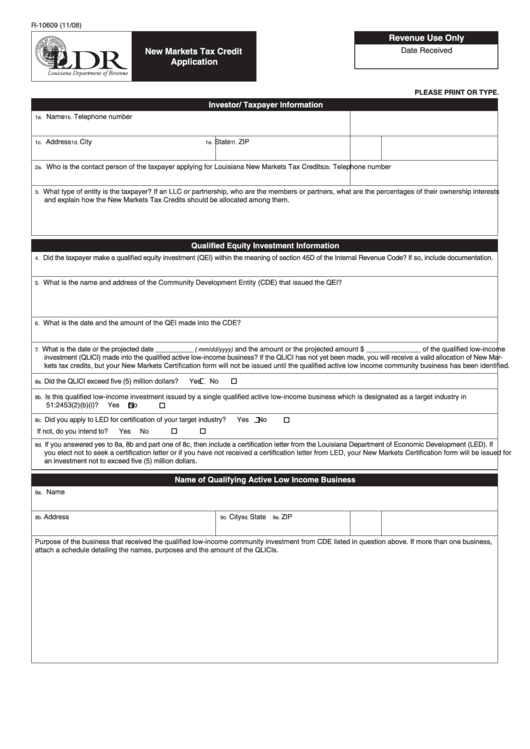

R-10609 (11/08)

Revenue Use Only

New Markets Tax Credit

Date Received

Application

PLEASE PRINT OR TYPE.

Investor/ Taxpayer Information

Name

Telephone number

1a.

1b.

Address

City

State

ZIP

1c.

1d.

1e.

1f.

Who is the contact person of the taxpayer applying for Louisiana New Markets Tax Credits

Telephone number

2a.

2b.

What type of entity is the taxpayer? If an LLC or partnership, who are the members or partners, what are the percentages of their ownership interests

3.

and explain how the New Markets Tax Credits should be allocated among them.

Qualified Equity Investment Information

Did the taxpayer make a qualified equity investment (QEI) within the meaning of section 45D of the Internal Revenue Code? If so, include documentation.

4.

What is the name and address of the Community Development Entity (CDE) that issued the QEI?

5.

What is the date and the amount of the QEI made into the CDE?

6.

What is the date or the projected date __________

and the amount or the projected amount $ ______________ of the qualified low-income

( mm/dd/yyyy)

7 .

investment (QLICI) made into the qualified active low-income business? If the QLICI has not yet been made, you will receive a valid allocation of New Mar-

kets tax credits, but your New Markets Certification form will not be issued until the qualified active low income community business has been identified.

Did the QLICI exceed five (5) million dollars?

Yes

No

■

■

8a.

Is this qualified low-income investment issued by a single qualified active low-income business which is designated as a target industry in R.S.

8b.

51:2453(2)(b)(i)?

Yes

No

■

■

Did you apply to LED for certification of your target industry?

Yes

No

■

■

8c.

If not, do you intend to?

Yes

No

■

■

If you answered yes to 8a, 8b and part one of 8c, then include a certification letter from the Louisiana Department of Economic Development (LED). If

8d.

you elect not to seek a certification letter or if you have not received a certification letter from LED, your New Markets Certification form will be issued for

an investment not to exceed five (5) million dollars.

Name of Qualifying Active Low Income Business

Name

9a.

Address

City

State

ZIP

9b.

9c.

9d.

9e.

Purpose of the business that received the qualified low-income community investment from CDE listed in question above. If more than one business,

attach a schedule detailing the names, purposes and the amount of the QLICIs.

1

1 2

2