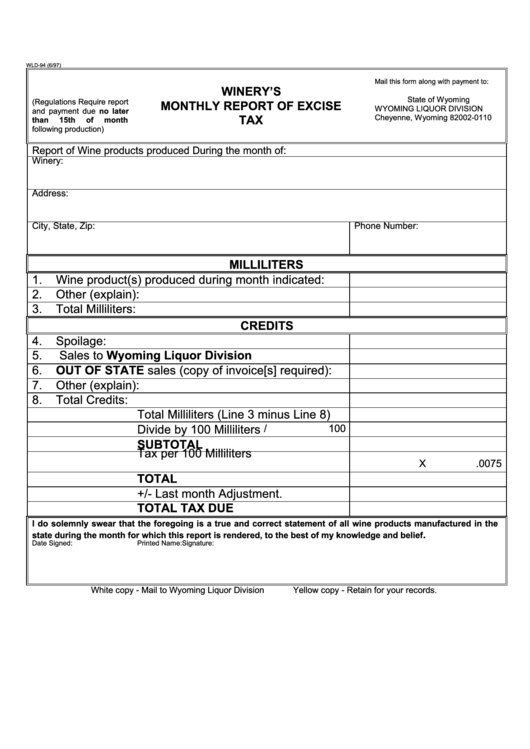

Form Wld-94 - Winery'S Monthly Report Of Excise Tax

ADVERTISEMENT

WLD-94 (6/97)

Mail this form along with payment to:

WINERY’S

State of Wyoming

(Regulations Require report

MONTHLY REPORT OF EXCISE

WYOMING LIQUOR DIVISION

and payment due no later

Cheyenne, Wyoming 82002-0110

TAX

than

15th

of

month

following production)

Report of Wine products produced During the month of:

Winery:

Address:

City, State, Zip:

Phone Number:

MILLILITERS

1.

Wine product(s) produced during month indicated:

2.

Other (explain):

3.

Total Milliliters:

CREDITS

4.

Spoilage:

5.

Sales to Wyoming Liquor Division

6.

OUT OF STATE sales (copy of invoice[s] required):

7.

Other (explain):

8.

Total Credits:

Total Milliliters (Line 3 minus Line 8)

Divide by 100 Milliliters

/

100

SUBTOTAL

Tax per 100 Milliliters

X

.0075

TOTAL

+/- Last month Adjustment.

TOTAL TAX DUE

I do solemnly swear that the foregoing is a true and correct statement of all wine products manufactured in the

.

state during the month for which this report is rendered, to the best of my knowledge and belief

Date Signed:

Printed Name:

Signature:

White copy - Mail to Wyoming Liquor Division

Yellow copy - Retain for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1