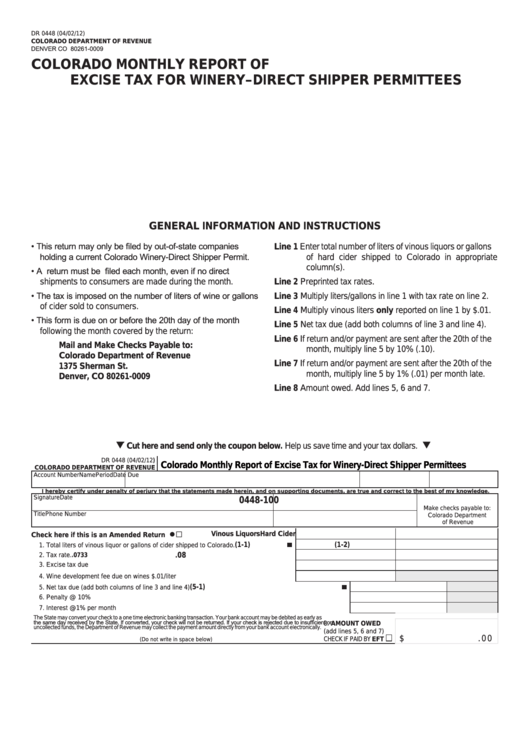

DR 0448 (04/02/12)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

COLORADO MONTHLY REPORT OF

EXCISE TAX FOR WINERY–DIRECT SHIPPER PERMITTEES

GENERAL INFORMATION AND INSTRUCTIONS

• This return may only be filed by out-of-state companies

Line 1 Enter total number of liters of vinous liquors or gallons

holding a current Colorado Winery-Direct Shipper Permit.

of hard cider shipped to Colorado in appropriate

column(s).

• A return must be filed each month, even if no direct

shipments to consumers are made during the month.

Line 2 Preprinted tax rates.

• The tax is imposed on the number of liters of wine or gallons

Line 3 Multiply liters/gallons in line 1 with tax rate on line 2.

of cider sold to consumers.

Line 4 Multiply vinous liters only reported on line 1 by $.01.

• This form is due on or before the 20th day of the month

Line 5 Net tax due (add both columns of line 3 and line 4).

following the month covered by the return:

Line 6 If return and/or payment are sent after the 20th of the

Mail and Make Checks Payable to:

month, multiply line 5 by 10% (.10).

Colorado Department of Revenue

Line 7 If return and/or payment are sent after the 20th of the

1375 Sherman St.

month, multiply line 5 by 1% (.01) per month late.

Denver, CO 80261-0009

Line 8 Amount owed. Add lines 5, 6 and 7.

Cut here and send only the coupon below. Help us save time and your tax dollars.

DR 0448 (04/02/12)

Colorado Monthly Report of Excise Tax for Winery-Direct Shipper Permittees

COLORADO DEPARTMENT OF REVENUE

Account Number

Name

Period

Date Due

I hereby certify under penalty of perjury that the statements made herein, and on supporting documents, are true and correct to the best of my knowledge.

Signature

Date

0448-100

Make checks payable to:

Title

Phone Number

Colorado Department

of Revenue

□

●

Vinous Liquors

Hard Cider

Check here if this is an Amended Return ...........................................................

(1-1)

(1-2)

1. Total liters of vinous liquor or gallons of cider shipped to Colorado. ............................

.08

2. Tax rate. .......................................................................................................................

.0733

3. Excise tax due .............................................................................................................

4. Wine development fee due on wines $.01/liter ............................................................

(5-1)

5. Net tax due (add both columns of line 3 and line 4) ..................................................................................

6. Penalty @ 10% ..........................................................................................................................................

7. Interest @1% per month ...........................................................................................................................

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as

the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or

8. AMOUNT OWED

uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

(add lines 5, 6 and 7)

$

. 0 0

CHECK IF PAID BY EFT

(Do not write in space below)

1

1