Form Dr 0442 - Monthly Report Of Excise Tax For Alcoholic Beverages

ADVERTISEMENT

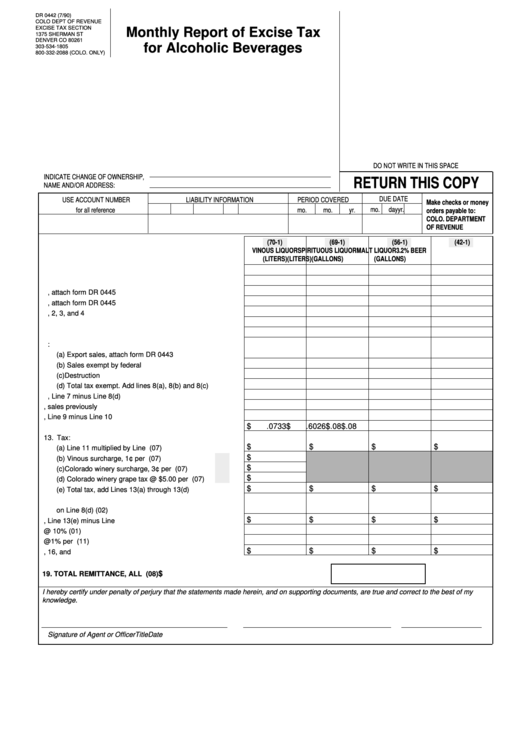

DR 0442 (7/90)

COLO DEPT OF REVENUE

EXCISE TAX SECTION

Monthly Report of Excise Tax

1375 SHERMAN ST

DENVER CO 80261

for Alcoholic Beverages

303-534-1805

800-332-2088 (COLO. ONLY)

DO NOT WRITE IN THIS SPACE

INDICATE CHANGE OF OWNERSHIP,

RETURN THIS COPY

NAME AND/OR ADDRESS:

DUE DATE

USE ACCOUNT NUMBER

LIABILITY INFORMATION

PERIOD COVERED

Make checks or money

mo.

day

yr.

for all reference

county

city

indust.

type

liability date

mo.

mo.

yr.

orders payable to:

COLO. DEPARTMENT

OF REVENUE

(70-1)

(69-1)

(56-1)

(42-1)

VINOUS LIQUOR

SPIRITUOUS LIQUOR

MALT LIQUOR

3.2% BEER

(LITERS)

(LITERS)

(GALLONS)

(GALLONS)

1. Beginning inventory ...............................................................

2. Manufactured in Colorado .....................................................

3. Purchased tax not included, attach form DR 0445 ................

4. Purchased tax included, attach form DR 0445 ......................

5. Total Lines 1, 2, 3, and 4 .......................................................

6. Ending inventory ....................................................................

7. Line 5 minus Line 6 ...............................................................

8. Tax exempt dispositions:

(a) Export sales, attach form DR 0443 ..................................

(b) Sales exempt by federal law ............................................

(c) Destruction .......................................................................

(d) Total tax exempt. Add lines 8(a), 8(b) and 8(c) ................

9. Taxable sales, Line 7 minus Line 8(d) ...................................

10. To the extent included in Line 9, sales previously taxed .......

11. Tax due sales, Line 9 minus Line 10 .....................................

$

.0733

$

.6026

$

.08

$

.08

12. Tax rate .................................................................................

13. Tax:

$

$

$

$

(a) Line 11 multiplied by Line 12 ..................................... (07)

$

(b) Vinous surcharge, 1¢ per liter ............................ 33-1(07)

$

(c) Colorado winery surcharge, 3¢ per liter ............. 60-1(07)

$

(d) Colorado winery grape tax @ $5.00 per ton ...... 63-1(07)

$

$

$

$

(e) Total tax, add Lines 13(a) through 13(d) ..........................

14. Tax previously paid on liters or gallons included

on Line 8(d) .................................................................... (02)

$

$

$

$

15. Net tax due, Line 13(e) minus Line 14 ...................................

16. Penalty @ 10% ............................................................... (01)

17. Interest @1% per month ................................................. (11)

$

$

$

$

18. Total due. Add Lines 15, 16, and 17 ......................................

$

19. TOTAL REMITTANCE, ALL COLUMNS ...................................................................... (08)

I hereby certify under penalty of perjury that the statements made herein, and on supporting documents, are true and correct to the best of my

knowledge.

Signature of Agent or Officer

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1