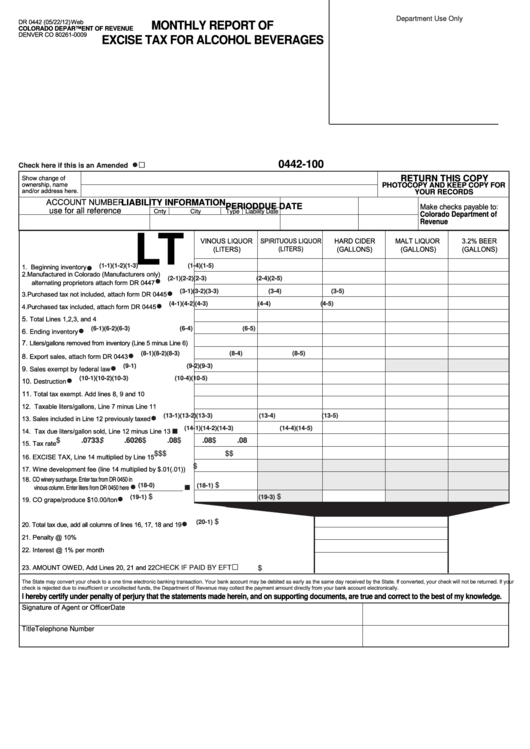

Department Use Only

DR 0442 (05/22/12)

Web

MONTHLY REPORT OF

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

EXCISE TAX FOR ALCOHOL BEVERAGES

□

●

0442-100

Check here if this is an Amended Return.......................................................

RETURN THIS COPY

Show change of

ownership, name

PHOTOCOPY AND KEEP COPY FOR

and/or address here.

YOUR RECORDS

ACCOUNT NUMBER

LIABILITY INFORMATION

Make checks payable to:

PERIOD

DUE DATE

Cnty

City

use for all reference

Type

Liability Date

Colorado Department of

Revenue

LT

VINOUS LIQUOR

SPIRITUOUS LIQUOR

HARD CIDER

MALT LIQUOR

3.2% BEER

(LITERS)

(LITERS)

(GALLONS)

(GALLONS)

(GALLONS)

●

1. Beginning inventory

(1-1)

(1-2)

(1-3)

(1-4)

(1-5)

.................................................

2. Manufactured in Colorado (Manufacturers only)

●

(2-1)

(2-2)

(2-3)

(2-4)

(2-5)

alternating proprietors attach form DR 0447

..............

●

(3-1)

(3-2)

(3-3)

(3-4)

(3-5)

3. Purchased tax not included, attach form DR 0445

.....

●

(4-1)

(4-2)

(4-3)

(4-4)

(4-5)

4. Purchased tax included, attach form DR 0445

...........

5.

Total Lines 1,2,3, and 4

...............................................

●

(6-1)

(6-2)

(6-3)

(6-4)

(6-5)

6.

......................................................

Ending inventory

7.

Liters/gallons removed from inventory (Line 5 minus Line 6)

●

(8-1)

(8-2)

(8-3)

(8-4)

(8-5)

8.

Export sales, attach form DR 0443

...........................

●

(9-1)

(9-2)

(9-3)

9.

Sales exempt by federal law .......................................

●

(10-1)

(10-2)

(10-3)

(10-4)

(10-5)

10.

Destruction ................................................................

11.

Total tax exempt. Add lines 8, 9 and 10

12. Taxable liters/gallons, Line 7 minus Line 11 ..................

●

(13-1)

(13-2)

(13-3)

(13-4)

(13-5)

13. Sales included in Line 12 previously taxed ...............

(14-1)

(14-2)

(14-3)

(14-4)

(14-5)

14. Tax due liters/gallon sold, Line 12 minus Line 13 .....

n

$

.0733

$

.6026

$

.08

$

.08

$

.08

15. Tax rate

....................................................................

$

$

$

$

$

16. EXCISE TAX, Line 14 multiplied by Line 15

................

$

17. Wine development fee (line 14 multiplied by $.01(.01))

18. CO winery surcharge. Enter tax from DR 0450 in

●

$

(18-0)

(18-1)

vinous column. Enter liters from DR 0450 here

n

____________

●

$

$

(19-1)

(19-3)

19. CO grape/produce $10.00/ton

.................................

●

$

(20-1)

20. Total tax due, add all columns of lines 16, 17, 18 and 19

.............................................................

21. Penalty @ 10% ..............................................................................................................................

22. Interest @ 1% per month ...............................................................................................................

□

CHECK IF PAID BY EFT

23. AMOUNT OWED, Add Lines 20, 21 and 22...........................

$

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be returned. If your

check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

I hereby certify under penalty of perjury that the statements made herein, and on supporting documents, are true and correct to the best of my knowledge.

Signature of Agent or Officer

Date

Title

Telephone Number

1

1 2

2