Form 811 - Revenue Stamp Transaction

ADVERTISEMENT

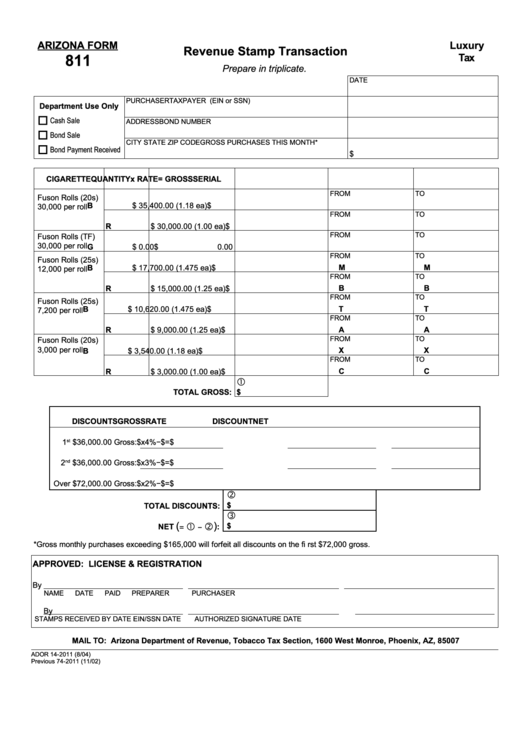

ARIZONA FORM

Luxury

Revenue Stamp Transaction

Tax

811

Prepare in triplicate.

DATE

PURCHASER

TAXPAYER I.D. NO. (EIN or SSN)

Department Use Only

Cash Sale

ADDRESS

BOND NUMBER

Bond Sale

CITY

STATE

ZIP CODE

GROSS PURCHASES THIS MONTH*

Bond Payment Received

$

CIGARETTE

QUANTITY

x RATE

= GROSS

SERIAL NO.

SERIAL NO.

FROM

TO

Fuson Rolls (20s)

B

$ 35,400.00 (1.18 ea)

$

30,000 per roll

FROM

TO

R

$ 30,000.00 (1.00 ea)

$

FROM

TO

Fuson Rolls (TF)

30,000 per roll

G

$

0.00

$

0.00

FROM

TO

Fuson Rolls (25s)

M

M

B

$ 17,700.00 (1.475 ea) $

12,000 per roll

FROM

TO

R

$ 15,000.00 (1.25 ea)

$

B

B

FROM

TO

Fuson Rolls (25s)

T

T

B

$ 10,620.00 (1.475 ea) $

7,200 per roll

FROM

TO

A

A

R

$ 9,000.00 (1.25 ea)

$

FROM

TO

Fuson Rolls (20s)

3,000 per roll

B

$ 3,540.00 (1.18 ea)

$

X

X

FROM

TO

C

C

R

$ 3,000.00 (1.00 ea)

$

TOTAL GROSS: $

DISCOUNTS

GROSS

RATE

DISCOUNT

NET

1

st

$36,000.00 Gross: $

x

4%

−

$

=

$

2

nd

$36,000.00 Gross: $

x

3%

−

$

=

$

Over $72,000.00 Gross: $

x

2%

−

$

=

$

TOTAL DISCOUNTS: $

(

)

: $

NET

=

−

*Gross monthly purchases exceeding $165,000 will forfeit all discounts on the fi rst $72,000 gross.

APPROVED: LICENSE & REGISTRATION

By

NAME

DATE

PAID PREPARER

PURCHASER

By

STAMPS RECEIVED BY

DATE

EIN/SSN

DATE

AUTHORIZED SIGNATURE

DATE

MAIL TO: Arizona Department of Revenue, Tobacco Tax Section, 1600 West Monroe, Phoenix, AZ, 85007

ADOR 14-2011 (8/04)

Previous 74-2011 (11/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1