Form 8454t - Taxpayer Filing Election Opt Out Form - Virginia Department Of Taxation - Virginia

ADVERTISEMENT

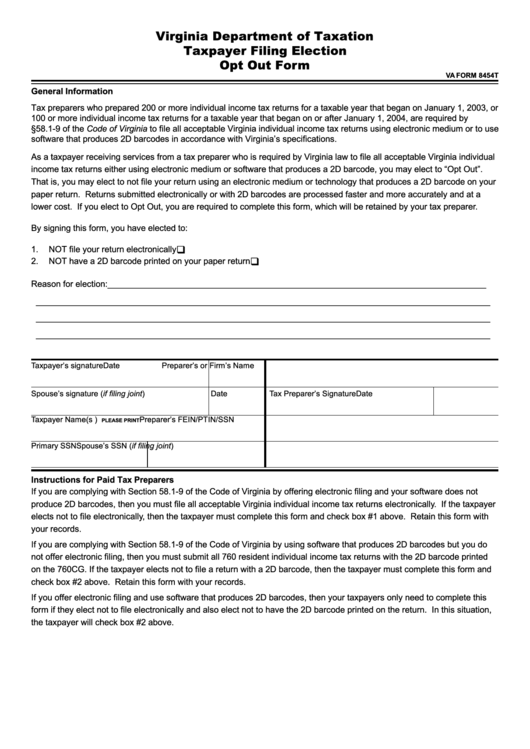

Virginia Department of Taxation

Taxpayer Filing Election

Opt Out Form

VA FORM 8454T

General Information

Tax preparers who prepared 200 or more individual income tax returns for a taxable year that began on January 1, 2003, or

100 or more individual income tax returns for a taxable year that began on or after January 1, 2004, are required by

§58.1-9 of the Code of Virginia to file all acceptable Virginia individual income tax returns using electronic medium or to use

software that produces 2D barcodes in accordance with Virginia’s specifications.

As a taxpayer receiving services from a tax preparer who is required by Virginia law to file all acceptable Virginia individual

income tax returns either using electronic medium or software that produces a 2D barcode, you may elect to “Opt Out”.

That is, you may elect to not file your return using an electronic medium or technology that produces a 2D barcode on your

paper return. Returns submitted electronically or with 2D barcodes are processed faster and more accurately and at a

lower cost. If you elect to Opt Out, you are required to complete this form, which will be retained by your tax preparer.

By signing this form, you have elected to:

1.

NOT file your return electronically

q

2.

NOT have a 2D barcode printed on your paper return

q

Reason for election: ________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

Taxpayer’s signature

Date

Preparer’s or Firm’s Name

Spouse’s signature (if filing joint)

Date

Tax Preparer’s Signature

Date

Taxpayer Name(s )

Preparer’s FEIN/PTIN/SSN

PLEASE PRINT

Primary SSN

Spouse’s SSN (if filing joint)

Instructions for Paid Tax Preparers

If you are complying with Section 58.1-9 of the Code of Virginia by offering electronic filing and your software does not

produce 2D barcodes, then you must file all acceptable Virginia individual income tax returns electronically. If the taxpayer

elects not to file electronically, then the taxpayer must complete this form and check box #1 above. Retain this form with

your records.

If you are complying with Section 58.1-9 of the Code of Virginia by using software that produces 2D barcodes but you do

not offer electronic filing, then you must submit all 760 resident individual income tax returns with the 2D barcode printed

on the 760CG. If the taxpayer elects not to file a return with a 2D barcode, then the taxpayer must complete this form and

check box #2 above. Retain this form with your records.

If you offer electronic filing and use software that produces 2D barcodes, then your taxpayers only need to complete this

form if they elect not to file electronically and also elect not to have the 2D barcode printed on the return. In this situation,

the taxpayer will check box #2 above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1