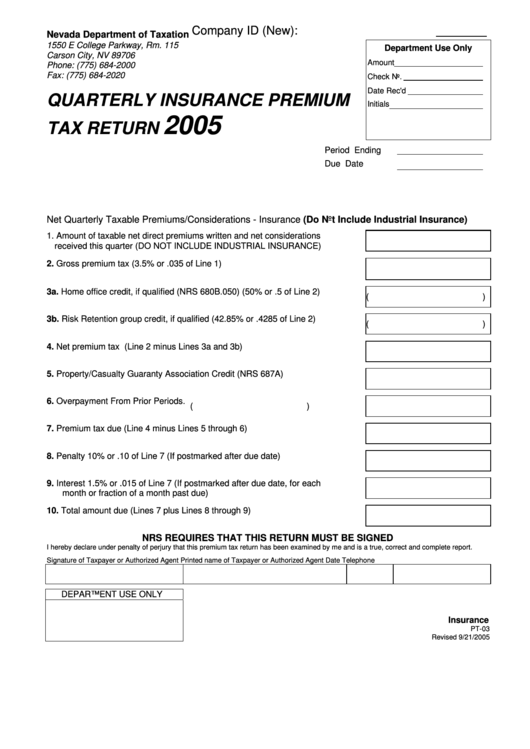

Form Pt-03 - Quarterly Insuarance Premium Tax Return - 2005

ADVERTISEMENT

Company ID (New):

Nevada Department of Taxation

1550 E College Parkway, Rm. 115

Department Use Only

Carson City, NV 89706

Amount

Phone: (775) 684-2000

Fax: (775) 684-2020

Check No.

Date Rec'd

QUARTERLY INSURANCE PREMIUM

Initials

2005

TAX RETURN

Period Ending

Due Date

Net Quarterly Taxable Premiums/Considerations - Insurance (Do Not Include Industrial Insurance)

1. Amount of taxable net direct premiums written and net considerations

received this quarter (DO NOT INCLUDE INDUSTRIAL INSURANCE)

2. Gross premium tax (3.5% or .035 of Line 1)

3a. Home office credit, if qualified (NRS 680B.050) (50% or .5 of Line 2)

(

)

3b. Risk Retention group credit, if qualified (42.85% or .4285 of Line 2)

(

)

4. Net premium tax (Line 2 minus Lines 3a and 3b)

5. Property/Casualty Guaranty Association Credit (NRS 687A)

6. Overpayment From Prior Periods.

(

)

7. Premium tax due (Line 4 minus Lines 5 through 6)

8. Penalty 10% or .10 of Line 7 (If postmarked after due date)

9. Interest 1.5% or .015 of Line 7 (If postmarked after due date, for each

month or fraction of a month past due)

10. Total amount due (Lines 7 plus Lines 8 through 9)

NRS REQUIRES THAT THIS RETURN MUST BE SIGNED

I hereby declare under penalty of perjury that this premium tax return has been examined by me and is a true, correct and complete report.

Signature of Taxpayer or Authorized Agent Printed name of Taxpayer or Authorized Agent

Date

Telephone

DEPARTMENT USE ONLY

Insurance

PT-03

Revised 9/21/2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1