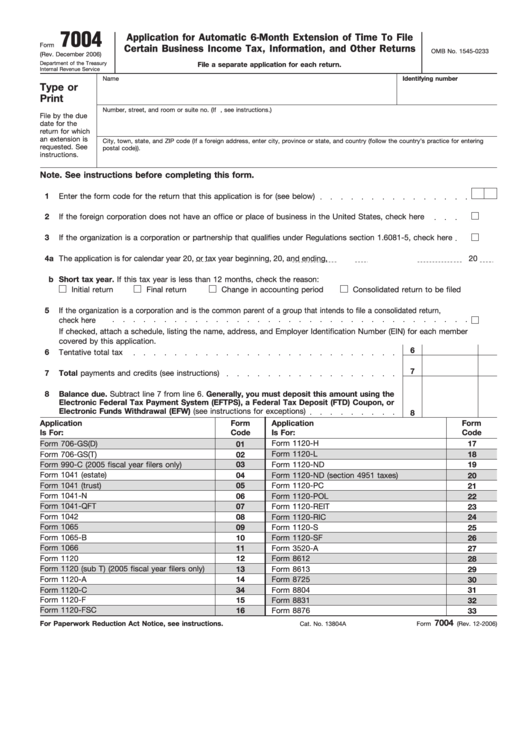

7004

Application for Automatic 6-Month Extension of Time To File

Form

Certain Business Income Tax, Information, and Other Returns

OMB No. 1545-0233

(Rev. December 2006)

Department of the Treasury

File a separate application for each return.

Internal Revenue Service

Name

Identifying number

Type or

Print

Number, street, and room or suite no. (If P.O. box, see instructions.)

File by the due

date for the

return for which

an extension is

City, town, state, and ZIP code (If a foreign address, enter city, province or state, and country (follow the country’s practice for entering

requested. See

postal code)).

instructions.

Note. See instructions before completing this form.

1

Enter the form code for the return that this application is for (see below)

2

If the foreign corporation does not have an office or place of business in the United States, check here

3

If the organization is a corporation or partnership that qualifies under Regulations section 1.6081-5, check here

4a

The application is for calendar year 20

, or tax year beginning

, 20

, and ending

,

20

b

Short tax year. If this tax year is less than 12 months, check the reason:

Initial return

Final return

Change in accounting period

Consolidated return to be filed

5

If the organization is a corporation and is the common parent of a group that intends to file a consolidated return,

check here

If checked, attach a schedule, listing the name, address, and Employer Identification Number (EIN) for each member

covered by this application.

6

6

Tentative total tax

7

7

Total payments and credits (see instructions)

8

Balance due. Subtract line 7 from line 6. Generally, you must deposit this amount using the

Electronic Federal Tax Payment System (EFTPS), a Federal Tax Deposit (FTD) Coupon, or

Electronic Funds Withdrawal (EFW) (see instructions for exceptions)

8

Application

Form

Application

Form

Is For:

Code

Is For:

Code

Form 1120-H

Form 706-GS(D)

17

01

Form 706-GS(T)

Form 1120-L

18

02

Form 1120-ND

Form 990-C (2005 fiscal year filers only)

03

19

Form 1041 (estate)

04

Form 1120-ND (section 4951 taxes)

20

Form 1041 (trust)

05

Form 1120-PC

21

Form 1041-N

06

Form 1120-POL

22

Form 1041-QFT

Form 1120-REIT

07

23

Form 1042

08

Form 1120-RIC

24

Form 1065

09

Form 1120-S

25

Form 1065-B

10

Form 1120-SF

26

Form 1066

11

Form 3520-A

27

Form 1120

12

Form 8612

28

Form 1120 (sub T) (2005 fiscal year filers only)

13

Form 8613

29

Form 1120-A

14

Form 8725

30

Form 1120-C

34

Form 8804

31

Form 1120-F

15

Form 8831

32

Form 1120-FSC

16

Form 8876

33

7004

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 13804A

Form

(Rev. 12-2006)

1

1