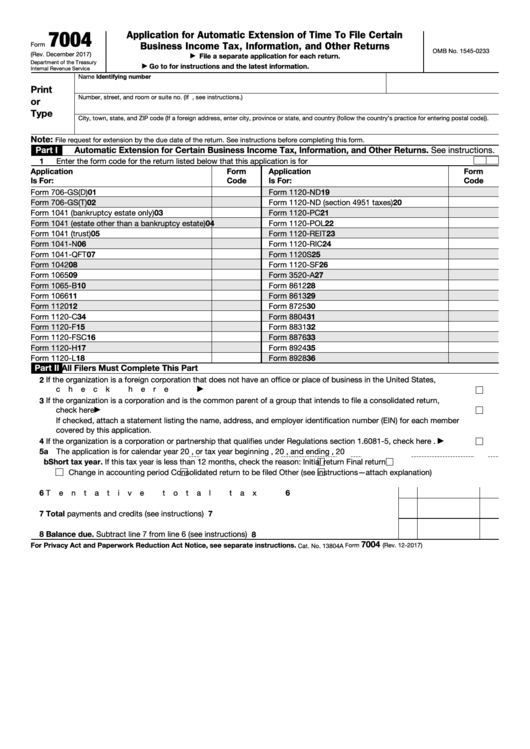

7004

Application for Automatic Extension of Time To File Certain

Business Income Tax, Information, and Other Returns

Form

OMB No. 1545-0233

(Rev. December 2017)

File a separate application for each return.

▶

Department of the Treasury

Go to for instructions and the latest information.

▶

Internal Revenue Service

Name

Identifying number

Print

Number, street, and room or suite no. (If P.O. box, see instructions.)

or

Type

City, town, state, and ZIP code (If a foreign address, enter city, province or state, and country (follow the country’s practice for entering postal code)).

Note:

File request for extension by the due date of the return. See instructions before completing this form.

Part I

Automatic Extension for Certain Business Income Tax, Information, and Other Returns. See instructions.

1

Enter the form code for the return listed below that this application is for .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Application

Form

Application

Form

Is For:

Code

Is For:

Code

01

19

Form 706-GS(D)

Form 1120-ND

Form 706-GS(T)

02

Form 1120-ND (section 4951 taxes)

20

Form 1041 (bankruptcy estate only)

03

Form 1120-PC

21

04

22

Form 1041 (estate other than a bankruptcy estate)

Form 1120-POL

Form 1041 (trust)

05

Form 1120-REIT

23

Form 1041-N

06

Form 1120-RIC

24

07

25

Form 1041-QFT

Form 1120S

Form 1042

08

Form 1120-SF

26

Form 1065

09

Form 3520-A

27

10

28

Form 1065-B

Form 8612

Form 1066

11

Form 8613

29

Form 1120

12

Form 8725

30

Form 1120-C

34

Form 8804

31

15

32

Form 1120-F

Form 8831

Form 1120-FSC

16

Form 8876

33

Form 1120-H

17

Form 8924

35

18

36

Form 1120-L

Form 8928

Part II

All Filers Must Complete This Part

2

If the organization is a foreign corporation that does not have an office or place of business in the United States,

check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

3

If the organization is a corporation and is the common parent of a group that intends to file a consolidated return,

check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

If checked, attach a statement listing the name, address, and employer identification number (EIN) for each member

covered by this application.

4

If the organization is a corporation or partnership that qualifies under Regulations section 1.6081-5, check here .

▶

5a The application is for calendar year 20

, or tax year beginning

, 20

, and ending

, 20

b Short tax year. If this tax year is less than 12 months, check the reason:

Initial return

Final return

Change in accounting period

Consolidated return to be filed

Other (see instructions—attach explanation)

6

6

Tentative total tax .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Total payments and credits (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Balance due. Subtract line 7 from line 6 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

8

7004

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 12-2017)

Cat. No. 13804A

1

1