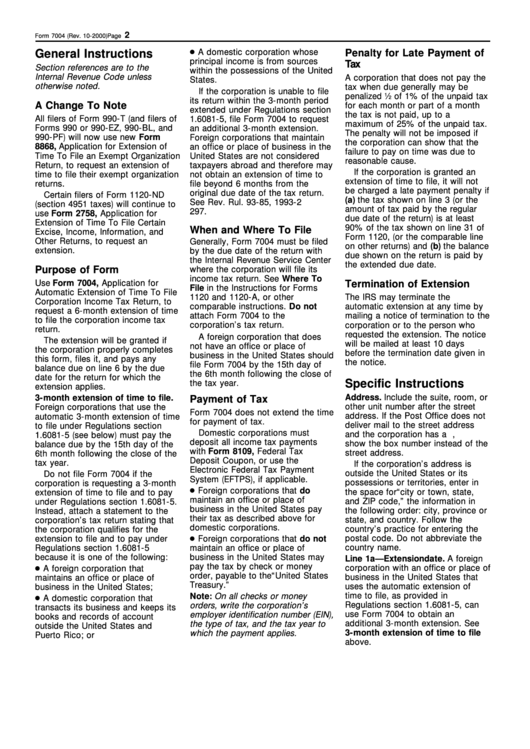

Form 7004 - Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns - Instructions

ADVERTISEMENT

2

Form 7004 (Rev. 10-2000)

Page

● A domestic corporation whose

Penalty for Late Payment of

General Instructions

principal income is from sources

Tax

Section references are to the

within the possessions of the United

Inter nal Revenue Code unless

A corporation that does not pay the

States.

otherwise noted.

tax when due generally may be

If the corporation is unable to file

penalized

1

⁄

of 1% of the unpaid tax

2

its return within the 3-month period

A Change To Note

for each month or part of a month

extended under Regulations section

the tax is not paid, up to a

All filers of Form 990-T (and filers of

1.6081-5, file Form 7004 to request

maximum of 25% of the unpaid tax.

Forms 990 or 990-EZ, 990-BL, and

an additional 3-month extension.

The penalty will not be imposed if

990-PF) will now use new Form

Foreign corporations that maintain

the corporation can show that the

8868, Application for Extension of

an office or place of business in the

failure to pay on time was due to

Time To File an Exempt Organization

United States are not considered

reasonable cause.

Return, to request an extension of

taxpayers abroad and therefore may

If the corporation is granted an

time to file their exempt organization

not obtain an extension of time to

extension of time to file, it will not

returns.

file beyond 6 months from the

be charged a late payment penalty if

original due date of the tax return.

Certain filers of Form 1120-ND

(a) the tax shown on line 3 (or the

See Rev. Rul. 93-85, 1993-2 C.B.

(section 4951 taxes) will continue to

amount of tax paid by the regular

297.

use Form 2758, Application for

due date of the return) is at least

Extension of Time To File Certain

90% of the tax shown on line 31 of

When and Where To File

Excise, Income, Information, and

Form 1120, (or the comparable line

Other Returns, to request an

Generally, Form 7004 must be filed

on other returns) and (b) the balance

extension.

by the due date of the return with

due shown on the return is paid by

the Internal Revenue Service Center

the extended due date.

Purpose of Form

where the corporation will file its

income tax return. See Where To

Use Form 7004, Application for

Termination of Extension

File in the Instructions for Forms

Automatic Extension of Time To File

1120 and 1120-A, or other

The IRS may terminate the

Corporation Income Tax Return, to

comparable instructions. Do not

automatic extension at any time by

request a 6-month extension of time

attach Form 7004 to the

mailing a notice of termination to the

to file the corporation income tax

corporation’s tax return.

corporation or to the person who

return.

requested the extension. The notice

A foreign corporation that does

The extension will be granted if

will be mailed at least 10 days

not have an office or place of

the corporation properly completes

before the termination date given in

business in the United States should

this form, files it, and pays any

the notice.

file Form 7004 by the 15th day of

balance due on line 6 by the due

the 6th month following the close of

date for the return for which the

Specific Instructions

the tax year.

extension applies.

Address. Include the suite, room, or

3-month extension of time to file.

Payment of Tax

other unit number after the street

Foreign corporations that use the

Form 7004 does not extend the time

address. If the Post Office does not

automatic 3-month extension of time

for payment of tax.

deliver mail to the street address

to file under Regulations section

Domestic corporations must

and the corporation has a P.O. box,

1.6081-5 (see below) must pay the

deposit all income tax payments

show the box number instead of the

balance due by the 15th day of the

with Form 8109, Federal Tax

street address.

6th month following the close of the

Deposit Coupon, or use the

tax year.

If the corporation’s address is

Electronic Federal Tax Payment

outside the United States or its

Do not file Form 7004 if the

System (EFTPS), if applicable.

possessions or territories, enter in

corporation is requesting a 3-month

● Foreign corporations that do

the space for “city or town, state,

extension of time to file and to pay

maintain an office or place of

and ZIP code,” the information in

under Regulations section 1.6081-5.

business in the United States pay

the following order: city, province or

Instead, attach a statement to the

their tax as described above for

state, and country. Follow the

corporation’s tax return stating that

domestic corporations.

country’s practice for entering the

the corporation qualifies for the

● Foreign corporations that do not

postal code. Do not abbreviate the

extension to file and to pay under

country name.

Regulations section 1.6081-5

maintain an office or place of

because it is one of the following:

business in the United States may

Line 1a—Extension date. A foreign

● A foreign corporation that

pay the tax by check or money

corporation with an office or place of

order, payable to the “United States

business in the United States that

maintains an office or place of

Treasury.”

uses the automatic extension of

business in the United States;

time to file, as provided in

● A domestic corporation that

Note: On all checks or money

Regulations section 1.6081-5, can

orders, wr ite the corporation’s

transacts its business and keeps its

use Form 7004 to obtain an

employer identification number (EIN),

books and records of account

additional 3-month extension. See

the type of tax, and the tax year to

outside the United States and

3-month extension of time to file

which the payment applies.

Puerto Rico; or

above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2