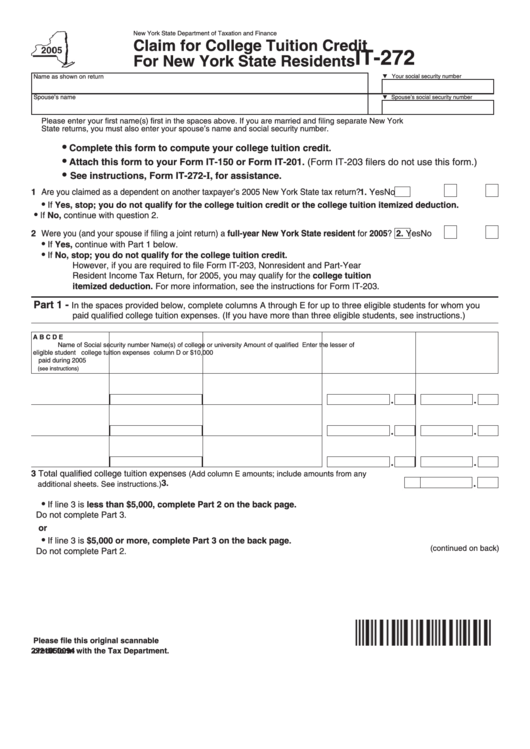

New York State Department of Taxation and Finance

Claim for College Tuition Credit

IT-272

For New York State Residents

Name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Please enter your first name(s) first in the spaces above. If you are married and filing separate New York

State returns, you must also enter your spouse’s name and social security number.

•

Complete this form to compute your college tuition credit.

•

Attach this form to your Form IT-150 or Form IT-201. (Form IT-203 filers do not use this form.)

•

See instructions, Form IT-272- I , for assistance.

1 Are you claimed as a dependent on another taxpayer’s 2005 New York State tax return? .............

1.

Yes

No

•

If Yes, stop; you do not qualify for the college tuition credit or the college tuition itemized deduction.

•

If No, continue with question 2.

2 Were you (and your spouse if filing a joint return) a full-year New York State resident for 2005?

2.

Yes

No

•

If Yes, continue with Part 1 below.

•

If No, stop; you do not qualify for the college tuition credit.

However, if you are required to file Form IT-203, Nonresident and Part-Year

Resident Income Tax Return, for 2005, you may qualify for the college tuition

itemized deduction. For more information, see the instructions for Form IT-203.

Part 1 -

In the spaces provided below, complete columns A through E for up to three eligible students for whom you

paid qualified college tuition expenses. (If you have more than three eligible students, see instructions.)

A

B

C

D

E

Name of

Social security number

Name(s) of college or university

Amount of qualified

Enter the lesser of

eligible student

college tuition expenses

column D or $10,000

paid during 2005

(see instructions)

3 Total qualified college tuition expenses

(Add column E amounts; include amounts from any

3.

..............................................................................................

additional sheets. See instructions.)

•

If line 3 is less than $5,000, complete Part 2 on the back page.

Do not complete Part 3.

or

•

If line 3 is $5,000 or more, complete Part 3 on the back page.

(continued on back)

Do not complete Part 2.

Please file this original scannable

2721050094

credit form with the Tax Department.

1

1 2

2