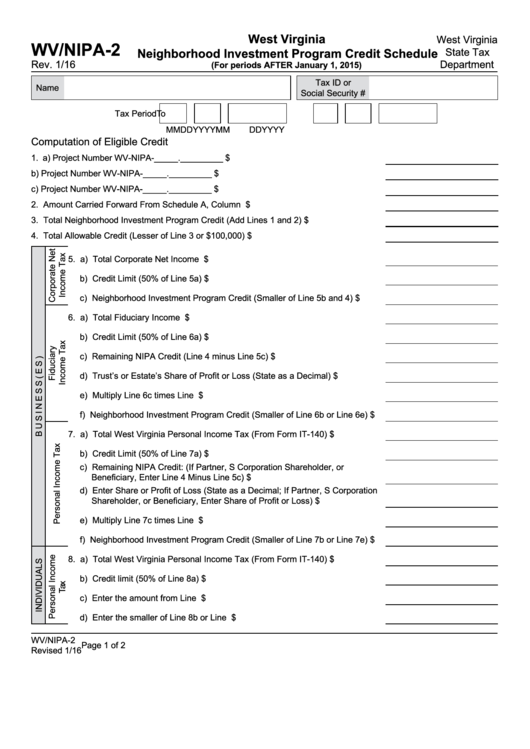

Form Wv/nipa-2 - Neighborhood Investment Program Credit Schedule - West Virginia State Tax Department

ADVERTISEMENT

West Virginia

West Virginia

WV/NIPA-2

Neighborhood Investment Program Credit Schedule

State Tax

Rev. 1/16

Department

(For periods AFTER January 1, 2015)

Tax ID or

Name

Social Security #

Tax Period

To

MM

DD

YYYY

MM

DD

YYYY

Computation of Eligible Credit

1. a) Project Number WV-NIPA-_____._________................................................................. $

b) Project Number WV-NIPA-_____._________................................................................. $

c) Project Number WV-NIPA-_____._________................................................................. $

2. Amount Carried Forward From Schedule A, Column 3...................................................... $

3. Total Neighborhood Investment Program Credit (Add Lines 1 and 2)................................ $

4. Total Allowable Credit (Lesser of Line 3 or $100,000)........................................................ $

5. a) Total Corporate Net Income Tax..................................................................... $

b) Credit Limit (50% of Line 5a).......................................................................... $

c) Neighborhood Investment Program Credit (Smaller of Line 5b and 4)...........$

6. a) Total Fiduciary Income Tax............................................................................. $

b) Credit Limit (50% of Line 6a).......................................................................... $

c) Remaining NIPA Credit (Line 4 minus Line 5c)...............................................$

d) Trust’s or Estate’s Share of Profit or Loss (State as a Decimal).....................$

e) Multiply Line 6c times Line 6d........................................................................ $

f) Neighborhood Investment Program Credit (Smaller of Line 6b or Line 6e).....$

7. a) Total West Virginia Personal Income Tax (From Form IT-140)....................... $

b) Credit Limit (50% of Line 7a).......................................................................... $

c) Remaining NIPA Credit: (If Partner, S Corporation Shareholder, or

Beneficiary, Enter Line 4 Minus Line 5c)........................................................ $

d) Enter Share or Profit of Loss (State as a Decimal; If Partner, S Corporation

Shareholder, or Beneficiary, Enter Share of Profit or Loss)............................ $

e) Multiply Line 7c times Line 7d........................................................................ $

f) Neighborhood Investment Program Credit (Smaller of Line 7b or Line 7e).....$

8. a) Total West Virginia Personal Income Tax (From Form IT-140)....................... $

b) Credit limit (50% of Line 8a)........................................................................... $

c) Enter the amount from Line 4......................................................................... $

d) Enter the smaller of Line 8b or Line 8c...........................................................$

WV/NIPA-2

Page 1 of 2

Revised 1/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2