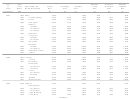

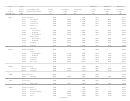

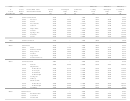

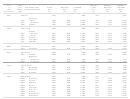

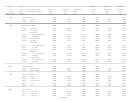

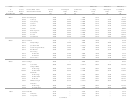

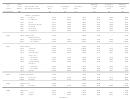

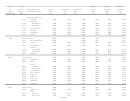

Tax Rates And Effective Tax Rates Sheet 2009-2010 Page 29

ADVERTISEMENT

Year

Sales

Effiective

Effiective

Effiective

of

Assess

COUNTIES AND

County

Municipal

Combined

County

Municipal

Combined

Latest

Ratio1

MUNICIPALITIES

Rate

Rate

Rate

Rate

Rate

Rate

Revaluation

2009

[$]

[$]

[$]

[$]

[$]

[$]

2009*

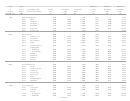

1.0046 Yadkin

.7400

…

.7400

.7434

…

.7434

1.0046

Boonville

.7400

.4600

1.2000

.7434

.4621

1.2055

1.0046

East Bend

.7400

.4800

1.2200

.7434

.4822

1.2256

1.0046

Jonesville

.7400

.4800

1.2200

.7434

.4822

1.2256

1.0046

Yadkinville

.7400

.3700

1.1100

.7434

.3717

1.1151

2008

.9883 Yancey

.4500

…

.4500

.4447

…

.4447

.9883

Burnsville

.4500

.5000

.9500

.4447

.4942

.9389

Notes:

All taxable property is assessed at 100% of appraised value and revaluation is effective January 1 of given year.

*

All counties must revalue real property at least every 8 years, but may elect to revalue more frequently. These counties have

adopted a more frequent revaluation schedule.

North Carolina Department of Revenue

Policy Analysis and Statistics Division

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29