FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

CHANGES

SUMMARY OF CHANGES & COMMON PROBLEM AREAS

SUMMARY

NEW

A personal compensation deduction worksheet has been developed for proprietors and partners to calculate and support the compensation for

personal services deduction allowed on proprietorship and partnership returns. The PROP-COMP worksheet (page 40) may be used by proprietors

and retained for their records. The PART-COMP worksheet (page 54) may be used by partners and retained for their records.

E-FILE

Access e-file at to make your Business Profits Tax, Business Enterprise Tax, Meals and Rentals Tax or Interest and Dividends

Tax estimates, extensions, returns, and tax notice payments on-line.

NO EXTENSION OF TIME TO PAY TAX

An extension of time to file your return is not an extension of time to pay the tax due. An automatic 7 month extension of time to file your return will

be granted, however, interest will be applied and penalties shall be assessed if 100% of the tax determined to be due has not been paid by the due

date of the tax. If the calculation on your extension indicates no additional balance due, please do not file an Application for Extension.

Access e-file or use Form BT-EXT for Business Taxes if you need to make an additional payment in order to have paid 100% of the tax due by the

original due date.

When you calculate the tax on your return during the extension period, if the tax balance due is greater than zero, then you did not pay 100% of the

tax by the original due date and interest will be applied and penalties shall be assessed. Do not file a request for an extension if no money is due.

To request an abatement of any penalties that may be assessed, please attach a letter and any supporting documentation (e.g. work papers for said

calculation, change of status, etc.) to the front of the return when filed. As long as 100% of the tax due has been paid by the original due date, you

have an automatic 7 month extension of time to file the return.

Even if you have filed a Federal and/or State extension, it is not necessary to attach a copy to your return.

BT SUMMARY STEP 2 - QUESTIONS MUST BE ANSWERED

Failure to answer questions in STEP 2 of the BT-Summary may result in inquiries from the Department which MAY generate late filing penalties.

BUSINESS ENTERPRISE TAX FILING THRESHOLDS

$150,000

$75,000

The filing threshold for the Business Enterprise Tax is

of gross business receipts from business activity everywhere or

of

the enterprise value tax base.

BUSINESS PROFITS TAX FILING THRESHOLDS

$50,000

The filing threshold for Business Profits Tax is gross business income in excess of

from business activity everywhere.

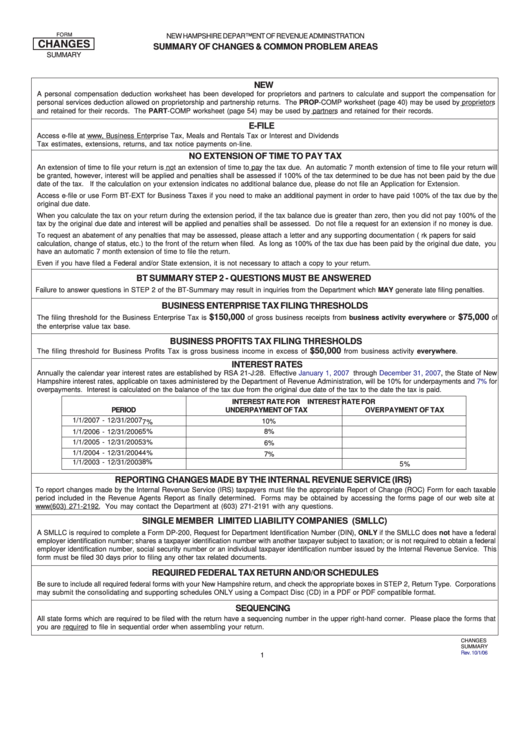

INTEREST RATES

Annually the calendar year interest rates are established by RSA 21-J:28. Effective

January 1, 2007

through

December 31,

2007,

the State of New

Hampshire interest rates, applicable on taxes administered by the Department of Revenue Administration, will be 10% for underpayments and

7%

for

overpayments. Interest is calculated on the balance of the tax due from the original due date of the tax to the date the tax is paid.

INTEREST RATE FOR

INTEREST RATE FOR

PERIOD

UNDERPAYMENT OF TAX

OVERPAYMENT OF TAX

1/1/2007 - 12/31/2007

10%

7%

8%

5%

1/1/2006 - 12/31/2006

1/1/2005 - 12/31/2005

3%

6%

1/1/2004 - 12/31/2004

4%

7%

8%

1/1/2003 - 12/31/2003

5%

REPORTING CHANGES MADE BY THE INTERNAL REVENUE SERVICE (IRS)

To report changes made by the Internal Revenue Service (IRS) taxpayers must file the appropriate Report of Change (ROC) Form for each taxable

period included in the Revenue Agents Report as finally determined. Forms may be obtained by accessing the forms page of our web site at

or by contacting the forms line at (603) 271-2192. You may contact the Department at (603) 271-2191 with any questions.

SINGLE MEMBER LIMITED LIABILITY COMPANIES (SMLLC)

A SMLLC is required to complete a Form DP-200, Request for Department Identification Number (DIN), ONLY if the SMLLC does not have a federal

employer identification number; shares a taxpayer identification number with another taxpayer subject to taxation; or is not required to obtain a federal

employer identification number, social security number or an individual taxpayer identification number issued by the Internal Revenue Service. This

form must be filed 30 days prior to filing any other tax related documents.

REQUIRED FEDERAL TAX RETURN AND/OR SCHEDULES

Be sure to include all required federal forms with your New Hampshire return, and check the appropriate boxes in STEP 2, Return Type. Corporations

may submit the consolidating and supporting schedules ONLY using a Compact Disc (CD) in a PDF or PDF compatible format.

SEQUENCING

All state forms which are required to be filed with the return have a sequencing number in the upper right-hand corner. Please place the forms that

you are required to file in sequential order when assembling your return.

CHANGES

SUMMARY

Rev. 10/1/06

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8