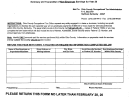

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

CHANGES

SUMMARY OF CHANGES & COMMON PROBLEM AREAS

SUMMARY

(Continued)

COMMON FILING ERRORS

BET/BPT-CORP

BET/BPT-PROP

INTEREST AND DIVIDENDS

Taxpayer fails to sign the return.

Taxpayer fails to sign the return.

Taxpayer fails to sign the return. Both taxpayers,

if filing a joint return, must sign the return on the

Both taxpayers, if filing a joint return, must sign

Failure to reconcile.

the return on the appropriate lines.

appropriate lines.

If Federal special depreciation or bonus

Proprietorship returns should not be filed jointly

Failure to code income on Line 4.

Nontaxable

depreciation is taken, reconcile using Schedule R.

when only one spouse has a business. Can not

income must be coded on Page 2, Line 4 on

file jointly if filing with a DIN.

Failure to report estimate or extension payments

Interest & Dividend tax return.

Failure to complete BT-Summary, Step Two.

and credit carryover on the return.

Taxpayer must check yes or no for BET and BPT

Failure to include page 2. Both pages 1 and 2 of

Taxpayer must report estimate or extension

filing requirements.

the return must be filed to be considered complete.

payments and credit carryover payments as

Failure to include all Federal Schedules. The

previously reported.

Failure to provide correct identification numbers.

return is incomplete unless all appropriate

schedules are included.

Taxpayers must provide complete and correct

Attachments not in order.

identification numbers.

Failure to apportion. Apportionment is required

Form number sequence not followed for

when business is conducted both within and

business return.

Failure to report estimate or extension payments

without New Hampshire see BET-80 and DP-80.

and credit carryover on the return. Taxpayer

Failure to reconcile.

If Federal Special

Failure to complete BT-Summary, Step Two.

must report estimate or extension payments and

Taxpayer must check yes or no for BET and

Depreciation or Bonus Depreciation is taken,

credit carryover payments as previously

BPT filing requirements.

reconcile using Schedule R.

reported.

Failure to submit a complete amended return. All

Failure to include all Federal Schedules. The

amended returns must include all appropriate

return is incomplete unless all appropriate

schedules.

schedules are included.

Failure to report estimate or extension payments

Failure to submit a complete amended return. All

and credit carryover on the return.

amended returns must include all appropriate

Taxpayer must report estimate or extension

schedules.

payments and credit carryover payments as

previously reported.

SIGNATURE(S) MUST BE IN INK

Please sign your return in ink. If required, your spouse and/or paid preparer must also sign the return in ink.

CONSISTENT ORDER

On all jointly filed documents, order of names and social security numbers should be consistent from year to year.

PAYMENT

a) Please make sure that the check amount equals the balance due amount shown on the form.

b) Complete the check and sign it.

c) DO NOT submit your check remittance stubs.

d) Enclose, but DO NOT staple or tape, your payment with the document you are submitting.

AVAILABILITY OF FORMS

Copies of the state tax forms may be obtained from our web site at or by visiting any of the 22 Depository Libraries located

throughout the State or from our forms line at (603) 271-2192.

The New Hampshire State Publication Depository Library program, established by RSA 202-B, guarantees that information published by state

agencies, including tax forms, laws and rules, are available to all citizens of the state through local libraries. Libraries participating in the Depository

program, where copies can be made for a fee, are:

Bedford Public Library, Bedford

Concord Public Library, Concord

Dartmouth College, Baker Library, Hanover

Derry Public Library, Derry

Fiske Free Library, Claremont

Franklin Public Library, Franklin

Keene State College, W.E. Mason Library, Keene

Kelley Library, Salem

Laconia Public Library, Laconia

Law Library, Supreme Court, Concord

Littleton Public Library, Littleton

Manchester City Library, Manchester

Nashua Public Library, Nashua

New England College, Danforth Library, Henniker

New Hampshire State Library, Concord

New Hampshire Technical College, Berlin

Peterborough Town Library, Peterborough

Plymouth State College, Herbert Lamson Library, Plymouth

Portsmouth Public Library, Portsmouth

Southern New Hampshire University - Shapiro Library, Manchester

University of New Hampshire, Diamond Library, Durham

St. Anselm College, Geisel Library, Manchester

FEDERAL DEPRECIATION AND NEW HAMPSHIRE RECONCILIATION

President George W. Bush signed PL 107-147, the "Job Creation and Worker Assistance Act," also known as the Economic Stimulus package and PL

108-27, Jobs Growth Tax Relief Reconciliation Act of 2003. Under these laws, there was a change to federal business taxpayer filings for 2001- 2004

calendar year returns which included bonus depreciation of the cost of capital assets placed in service between September 10, 2001 and January

1, 2005 or January 1, 2006, for certain assets.

The New Hampshire Legislature has not changed the current business tax laws to conform with the federal tax law changes. The Internal Revenue

Code (IRC) reference remains the Code in effect on December 31, 2000. Therefore, if these changes are used on your federal filing, business

taxpayers must recalculate their New Hampshire gross business profits. Since, under current New Hampshire law, the bonus depreciation and the

additional IRC Section 179 expense is not allowable, business taxpayers will have to adjust the taxable income reported on their federal return before

reporting their gross business profits on their New Hampshire business tax return. The adjustment will require the removal of the federal depreciation

and IRC Section 179 expense authorized under the "Job Creation and Worker Assistance Act" and only allow depreciation and IRC Section 179

expense as provided under the IRC in effect on December 31, 2000.

Schedule R has been provided in this booklet for each business entity type to assist businesses in recalculating their New Hampshire Gross Business

Profits. The completed Schedule R must be filed with the corresponding New Hampshire Business Tax return.

CHANGES

SUMMARY

2

Rev. 10/1/06

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8