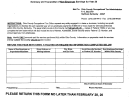

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

NH-1040

PROPRIETORSHIP BUSINESS PROFITS TAX RETURN

Instructions

LINE-BY-LINE INSTRUCTIONS (continued)

PROPRIETOR BET CREDIT WORKSHEET

Taxable period ended

Taxable period ended

Taxable period ended Taxable period ended

Taxable period ended

A

BET Credit

Carryforward Amount

*

See note below

B Current Period BET

Liability From BET-Prop,

Line 5(a), Column A

Expiring BET Credit

C

(

)

(

)

(

)

(

)

(

)

Carryforward

**

See note below

D

BET Credit available

(Sum of Lines A, B and C)

Enter on Line 17,

Column A of NH-1040

E

Current Period BPT

liability From NH-1040,

Line 16, Column A

F

BET Credit Deduction

this period

(the lesser of Line D

Enter on Line 18,

or Line E)

Column A of NH-1040

G

Credit Carryforward

Amount

(Line D minus Line

IF NEGATIVE, ENTER

F)

ZERO.

Carry this amount

forward and indicate on Line A

in subsequent period.

*Note: The Line A amount in the first column is from Line G, the credit carryforward amount, of the previous year’s BET CREDIT WORKSHEET.

If this is your initial year of the BET, enter zero.

** Note: The BET credit may be carried forward and allowed against BPT taxes due for 5 (five) taxable periods from the period in which the tax

was paid. Any unused credit prior to the 5 most current tax periods expiring in this taxable period is unavailable and should be included in Line C.

SPOUSE PROPRIETOR BET CREDIT WORKSHEET

Taxable period ended

Taxable period ended

Taxable period ended Taxable period ended

Taxable period ended

A

BET Credit

Carryforward Amount

**

See note below

B Current Period BET

liability from BET-Prop,

Line 5(a), Column B

Expiring BET Credit

C

(

)

(

)

(

)

(

)

(

)

Carryforward

**

See note below

D

BET Credit Available

(Sum of Lines A, B and C)

Enter on Line 17,

Column B of NH-1040

E

Current Period BPT

liability from NH-1040,

Line 16, Column B

F

BET Credit Deduction this

period

(the lesser of Line D or

Enter on Line 18,

Line E)

Column B of NH-1040

G

Credit Carryforward

Amount

(Line D minus Line

IF NEGATIVE,

F)

ENTER ZERO.

Carry this

amount forward and indicate on

Line A in subsequent period.

*Note: The Line A amount in the first column is from Line G, the credit carryforward amount, of the previous year’s BET CREDIT WORKSHEET.

If this is your initial year of the BET, enter zero.

** Note: The BET credit may be carried forward and allowed against BPT taxes due for 5 (five) taxable periods from the period in which the tax

was paid. Any unused credit prior to the 5 most current tax periods expiring in this taxable period is unavailable and should be included in Line C.

Line 18: Enter the lesser amount of Line 16 or Line 17. If Line 17 is greater than Line 16, then a “Business Enterprise Tax Credit”

STEP 3

carryforward exists. Any unused portion of the current period’s Business Enterprise Tax Credit may be carried forward

Figure

and allowed against any Business Profits Tax due in a subsequent taxable period.

Your

Line 19: BUSINESS PROFITS TAX NET OF STATUTORY CREDITS

(a)

Enter the amount of Line 16 minus Line 18.

Credits

(b)

Enter the sum of Line 19(a) Columns A and B. IF NEGATIVE, ENTER ZERO.

ENTER THE AMOUNT FROM LINE 19(b) ON LINE 1(b) OF THE BT-SUMMARY.

NH-1040

39

Instructions

Rev. 10/1/06

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8