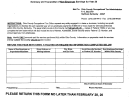

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

PROP-COMP

PROPRIETORSHIP BUSINESS PROFITS TAX

PERSONAL COMPENSATION DEDUCTION WORKSHEET

Worksheet

FOR TAXABLE PERIOD

THROUGH

PROPRIETORSHIP NAME OF BUSINESS

TAX ID NUMBER

PROPRIETOR NAME

1

Personal Compensation Deduction attributed to Proprietor (Enter on Line 7, Form NH-1040) ....................... 1 $

2

Approximate number of hours devoted to Proprietorship affairs during period ............................................. 2

3

Approximate number of hours devoted to other organizations during period ................................................ 3

4

Did Proprietor perform services for which another business organization paid (or will pay) salaries/wages? .. 4

YES

NO

Return on Non-Owner Employees and Business Assets

5

Number of employees ....................................................................................................................................... 5

6

Return on non-owner employees ..................................................................................................................... 6 $

(used in determining the personal compensation deduction, as required by RSA 77-A:4, III (a)

7

Fair market value of all Proprietorship assets (tangible and intangible) .......................................................... 7 $

8

Return on business assets ............................................................................................................................... 8 $

(used in determining the personal compensation deduction, as required by RSA 77-A:4, III (a)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Use the worksheet below to calculate the maximum deduction allowable under RSA 77-A:4, III. Please note that, even if the maximum allowable

deduction is greater than the value of fair and reasonable compensation for the personal services of the proprietor actually devoting time and effort in

the operation of the business organization, only the lower amount can be taken as a deduction on the return.

COMPUTATION OF MAXIMUM COMPENSATION DEDUCTION

9

Net profit or loss (Federal Form 1040, Schedule C) ........................................................................................ 9

10

Net farm profit or loss (Federal Form 1040, Schedule F) ................................................................................ 10

11

Net income from rental properties (Federal Form 1040, Schedule E, and Federal Form 4835) ...................... 11

12

Commission for services actually performed by the proprietor in brokering the sale of the business

organization's assets (Maximum commission not to exceed 15% of sales price shown on Federal Forms

4797 and 6252, and Federal Form 1065, Schedule D, reduced by any brokerage fee paid to other parties) .. 12

13

Maximum allowable compensation deduction (Sum of Lines 9 through 12) ................................................... 13

PROP-COMP

Worksheet

Rev. 10/1/06

40

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8