Instructions For Form 4669 - 2014

ADVERTISEMENT

Page 2

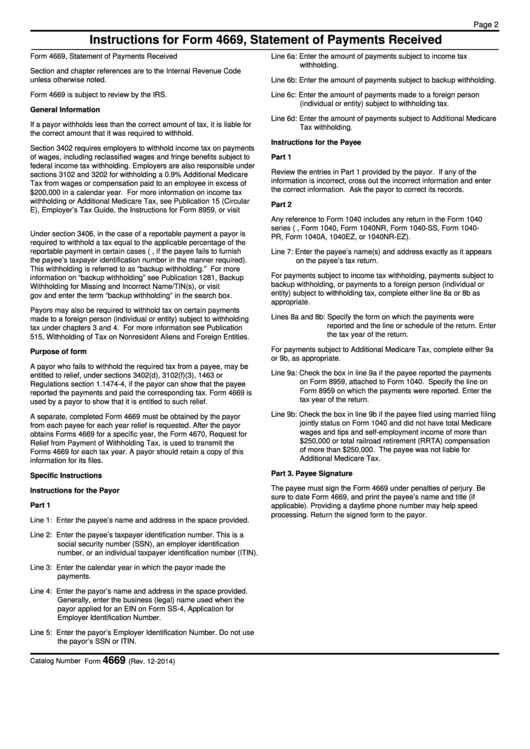

Instructions for Form 4669, Statement of Payments Received

Form 4669, Statement of Payments Received

Line 6a: Enter the amount of payments subject to income tax

withholding.

Section and chapter references are to the Internal Revenue Code

unless otherwise noted.

Line 6b: Enter the amount of payments subject to backup withholding.

Form 4669 is subject to review by the IRS.

Line 6c: Enter the amount of payments made to a foreign person

(individual or entity) subject to withholding tax.

General Information

Line 6d: Enter the amount of payments subject to Additional Medicare

If a payor withholds less than the correct amount of tax, it is liable for

Tax withholding.

the correct amount that it was required to withhold.

Instructions for the Payee

Section 3402 requires employers to withhold income tax on payments

of wages, including reclassified wages and fringe benefits subject to

Part 1

federal income tax withholding. Employers are also responsible under

Review the entries in Part 1 provided by the payor. If any of the

sections 3102 and 3202 for withholding a 0.9% Additional Medicare

information is incorrect, cross out the incorrect information and enter

Tax from wages or compensation paid to an employee in excess of

the correct information. Ask the payor to correct its records.

$200,000 in a calendar year. For more information on income tax

withholding or Additional Medicare Tax, see Publication 15 (Circular

Part 2

E), Employer’s Tax Guide, the Instructions for Form 8959, or visit

Any reference to Form 1040 includes any return in the Form 1040

series (e.g., Form 1040, Form 1040NR, Form 1040-SS, Form 1040-

Under section 3406, in the case of a reportable payment a payor is

PR, Form 1040A, 1040EZ, or 1040NR-EZ).

required to withhold a tax equal to the applicable percentage of the

reportable payment in certain cases (e.g., if the payee fails to furnish

Line 7: Enter the payee’s name(s) and address exactly as it appears

the payee’s taxpayer identification number in the manner required).

on the payee’s tax return.

This withholding is referred to as “backup withholding.” For more

For payments subject to income tax withholding, payments subject to

information on “backup withholding” see Publication 1281, Backup

backup withholding, or payments to a foreign person (individual or

Withholding for Missing and Incorrect Name/TIN(s), or visit

entity) subject to withholding tax, complete either line 8a or 8b as

gov and enter the term “backup withholding” in the search box.

appropriate.

Payors may also be required to withhold tax on certain payments

Lines 8a and 8b: Specify the form on which the payments were

made to a foreign person (individual or entity) subject to withholding

reported and the line or schedule of the return. Enter

tax under chapters 3 and 4. For more information see Publication

the tax year of the return.

515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

For payments subject to Additional Medicare Tax, complete either 9a

Purpose of form

or 9b, as appropriate.

A payor who fails to withhold the required tax from a payee, may be

Line 9a: Check the box in line 9a if the payee reported the payments

entitled to relief, under sections 3402(d), 3102(f)(3), 1463 or

on Form 8959, attached to Form 1040. Specify the line on

Regulations section 1.1474-4, if the payor can show that the payee

Form 8959 on which the payments were reported. Enter the

reported the payments and paid the corresponding tax. Form 4669 is

tax year of the return.

used by a payor to show that it is entitled to such relief.

Line 9b: Check the box in line 9b if the payee filed using married filing

A separate, completed Form 4669 must be obtained by the payor

jointly status on Form 1040 and did not have total Medicare

from each payee for each year relief is requested. After the payor

wages and tips and self-employment income of more than

obtains Forms 4669 for a specific year, the Form 4670, Request for

$250,000 or total railroad retirement (RRTA) compensation

Relief from Payment of Withholding Tax, is used to transmit the

of more than $250,000. The payee was not liable for

Forms 4669 for each tax year. A payor should retain a copy of this

Additional Medicare Tax.

information for its files.

Part 3. Payee Signature

Specific Instructions

The payee must sign the Form 4669 under penalties of perjury. Be

Instructions for the Payor

sure to date Form 4669, and print the payee’s name and title (if

Part 1

applicable). Providing a daytime phone number may help speed

processing. Return the signed form to the payor.

Line 1: Enter the payee’s name and address in the space provided.

Line 2: Enter the payee’s taxpayer identification number. This is a

social security number (SSN), an employer identification

number, or an individual taxpayer identification number (ITIN).

Line 3: Enter the calendar year in which the payor made the

payments.

Line 4: Enter the payor’s name and address in the space provided.

Generally, enter the business (legal) name used when the

payor applied for an EIN on Form SS-4, Application for

Employer Identification Number.

Line 5: Enter the payor’s Employer Identification Number. Do not use

the payor’s SSN or ITIN.

4669

Catalog Number 41877Z

gov

Form

(Rev. 12-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2