Form Ct-189-Wr - Claim For Refund Of Section 189 Tax And Tax Surcharges

ADVERTISEMENT

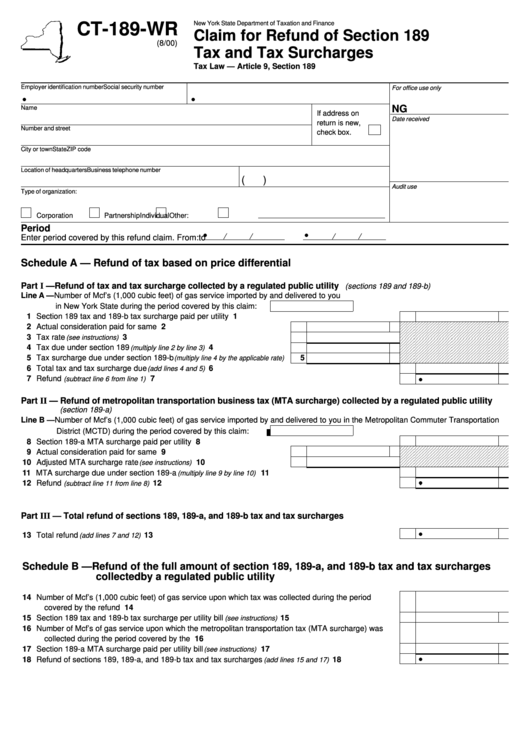

New York State Department of Taxation and Finance

CT-189-WR

Claim for Refund of Section 189

(8/00)

Tax and Tax Surcharges

Tax Law — Article 9, Section 189

Employer identification number

Social security number

For office use only

NG

Name

If address on

Date received

return is new,

Number and street

check box.

City or town

State

ZIP code

Location of headquarters

Business telephone number

(

)

Audit use

Type of organization:

Corporation

Partnership

Individual

Other:

Period

Enter period covered by this refund claim. From:

to

Schedule A — Refund of tax based on price differential

Part I — Refund of tax and tax surcharge collected by a regulated public utility

(sections 189 and 189-b)

Line A — Number of Mcf’s (1,000 cubic feet) of gas service imported by and delivered to you

in New York State during the period covered by this claim:

1 Section 189 tax and 189-b tax surcharge paid per utility bill .......................................................................

1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

2 Actual consideration paid for same period ................................................

2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

3 Tax rate

............................................................................

3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

(see instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

4 Tax due under section 189

....................................

4

(multiply line 2 by line 3)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

5 Tax surcharge due under section 189-b

5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

(multiply line 4 by the applicable rate)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

6 Total tax and tax surcharge due

......................................................................................

6

(add lines 4 and 5)

7 Refund

.................................................................................................................

7

(subtract line 6 from line 1)

Part II — Refund of metropolitan transportation business tax (MTA surcharge) collected by a regulated public utility

(section 189-a)

Line B — Number of Mcf’s (1,000 cubic feet) of gas service imported by and delivered to you in the Metropolitan Commuter Transportation

District (MCTD) during the period covered by this claim:

8 Section 189-a MTA surcharge paid per utility bill .........................................................................................

8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

9 Actual consideration paid for same period ................................................

9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

10 Adjusted MTA surcharge rate

..........................................

10

(see instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

11 MTA surcharge due under section 189-a

..............................................................

11

(multiply line 9 by line 10)

12 Refund

................................................................................................................

12

(subtract line 11 from line 8)

Part III — Total refund of sections 189, 189-a, and 189-b tax and tax surcharges

13 Total refund

....................................................................................................................

13

(add lines 7 and 12)

Schedule B — Refund of the full amount of section 189, 189-a, and 189-b tax and tax surcharges

collected by a regulated public utility

14 Number of Mcf’s (1,000 cubic feet) of gas service upon which tax was collected during the period

covered by the refund claim .....................................................................................................................

14

15 Section 189 tax and 189-b tax surcharge per utility bill

.....................................................

15

(see instructions)

16 Number of Mcf’s of gas service upon which the metropolitan transportation tax (MTA surcharge) was

collected during the period covered by the refund ...................................................................................

16

17 Section 189-a MTA surcharge paid per utility bill

..............................................................

17

(see instructions)

18 Refund of sections 189, 189-a, and 189-b tax and tax surcharges

.............................

18

(add lines 15 and 17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2