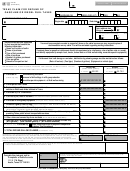

Form 14-202 (Back)(Rev.11-04/13)

INSTRUCTIONS FOR FILING TEXAS CLAIM FOR REFUND OF MOTOR VEHICLE TAX,

DIESEL MOTOR VEHICLE SURCHARGE, AND/OR COMMERCIAL VEHICLE REGISTRATION SURCHARGE

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance with

Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or toll-free number listed on this form.

WHO MAY FILE - The entity that paid the tax qualifies for refund of state tax paid on motor vehicles according to Comptroller’s Rule 3.75.

WHEN TO FILE - Claims for refund of Motor Vehicle Tax must be postmarked within four years of the date tax was due. Tax is due on the 20th working day after

the day the vehicle is delivered to the purchaser or brought into this state.

DOCUMENTS REQUIRED - Copy of the Tax Collector’s Receipt for Texas Title Application / Registration / Motor Vehicle Tax and signed buyer’s order

or purchase invoice received from the seller must be submitted with all claims for refund. Refer to reason codes below for a list of additional documen-

tation required. This office reserves the right to request any additional documentation necessary to verify a refund request.

FEDERAL PRIVACY ACT STATEMENT-- Disclosure of your social security number (SSN) is required and authorized under law. Authority: 42 U.S.C. Sec.

405(c)(2)(C)(i); Tex. Gov't. Code, Secs. 403.011, 403.015, and 403.178. The number will be used for tax administration and identification of any individual

affected by the law. The number may also be used to assist in the administration of laws relating to child support enforcement and the identification of

individuals who may be indebted to, or owe delinquent taxes to, the state. Release of information on this form in response to a public information request will

be governed by the Public Information Act, Chapter 552, Government Code.

STATE INFORMATION NOTICE UNDER CHAPTER 559, GOVERNMENT CODE -- With few exceptions, you are entitled upon request to be informed about the

information that we collect about you. Under Sections 552.021 and 552.023 of the Government Code, you are entitled to receive and review the information. Under

Section 559.004 of the Government Code, you are entitled to have us correct any information about you that is in our possession and that is incorrect. If at any time

you are concerned that your personal information held by us is incorrect, and you are unsure of how to correct or update it, please contact us at 1-800-252-1382.

SPECIFIC INSTRUCTIONS

ITEM c - Enter your 11-digit taxpayer number assigned by the State of Texas.

• Public agencies, state or federal organizations and volunteer fire depart-

If you do not have a number previously assigned by the state, use the

ments with exempt plates.

following:

• Inherited vehicles - must include a copy of the will or order of the probate

• Social Security Number if you are an individual recipient or sole owner of a

court.

business.

I - Penalty paid in error - penalty was paid but is not considered due by the

• Federal Employer’s Identification (FEI) Number if you are a corporation,

taxpayer. Must include a written statement of why the penalty was paid and

partnership, or other entity.

the reason for the request for waiver of that penalty.

J - Tax paid on a vehicle with apportioned registration - include a copy of the

ITEM d - Enter the vehicle identification number indicated on the Tax

cab card.

Collector’s Receipt for Texas Title Application / Registration / Motor Vehicle

K - Vehicle modified for an orthopedically handicapped individual - for a

Tax.

driver’s exemption, include a copy of a restricted Texas Driver’s License

requiring modification for the vehicle and a copy of the modification invoice.

ITEMS h & k - Enter the receipt transaction number and date of the Tax

For a transportation exemption, include a copy of the modification invoice

Collector’s Receipt for Texas Title Application / Registration / Motor Vehicle

and medical documentation showing when the individual being transported

Tax.

became orthopedically handicapped. Tax code requires modification be com-

ITEM i - Select a reason code:

pleted within two years of purchase.

A - The sale was never completed and all money has been returned to the

L - Dealer cancels dealer plates - must include a letter from the Texas De-

purchaser. This includes all buybacks, backouts and reversals. Include a

partment of Transportation.

copy of any cancelled refund checks issued to the buyer.

M - Lemon law cancellations - must include a copy of the cancellation

B - Collecting entity miscalculated the tax - must include a letter from the

worksheet and copy of the refund check received.

collecting entity explaining the error.

N - Certain licensed child care facilities exemption - must include a copy of a

C - Motor Vehicle Tax was paid when only the New Resident Tax, Transfer

license from the Texas Department of Protective and Regulatory Services.

Fee, or Gift Tax was due.

O - Off road vehicles

• New Resident Tax- must include a tax receipt from another state. (NOTE:

P - Fair market value deduction - subject to the approval of the Comptroller.

New resident tax increased to $90 from $15, effective 9/1/99)

Include documentation identifying vehicle(s) being used as tax credits.

• Gift Tax - must include a signed letter from the donor stating the vehicle was a

Q - Other - reasons must be pre-approved by the Comptroller’s office and

gift.

thoroughly documented.

• Even trade transfer fee.

ITEM l - Enter the 17-digit document number from title application receipt.

D - Tax paid on a stolen vehicle - must include a copy of the police report.

E - Tax paid on incorrect sales price.

ITEM 5 - Column A: Multiply the amount in Item 4 by the tax rate of .0625. If

F - Credit not taken for tax paid to another state - must include a tax receipt

you owe no tax due to reason codes A, D, G, H, J, K, L, M, or N, enter a zero

from another state.

in Item 5.

G - Vehicle assigned / transferred in error - include the incorrect and correct

tax receipts.

ITEM 8 - Refer to Penalty paid in error definition, Item I, Reason code I.

H - Tax paid in error - tax was paid but was never due. The following are

ITEM 11 - Refer to Commercial Vehicles and Truck Tractor registration sur-

organizations or situations that are exempt from payment of motor vehicle

charge refund Reason Codes R, S, T, and U.

tax.

• Church or religious society vehicle that carries more than six passengers -

INSTRUCTIONS FOR SECTION II

must include a written statement from the church or religious society that

R - IRP Registration Refunds - Must include a copy of the cab card and a

the vehicle is used to provide transportation only to and from church, reli-

copy of the IRP Refund Supplement Sheet provided by Texas Department

gious services or meetings.

of Transportation (TXDOT).

• Foreign military personnel attached to a NATO force - must include proof of

S - Combination Registration Refunds - Must include a copy of a validated

purchase outside of Texas, military travel orders and a military ID.

Registration Renewal Receipt and the Registration Fee Refund Request/

• Driver training vehicles - must include a letter signed by both the driver

Authorization Form, VTR-304, provided by TXDOT.

training school and the dealership stating the vehicle is loaned free of

T - Forestry Registration Refunds - Must include a copy of the cab card and

charge to a public school and used exclusively in an approved course.

a copy of the Forestry IRP Refund Supplement Sheet provided by TXDOT.

• Farm use vehicles - must include a statement from the farmer or the rancher

U - IRP Audits - Must include a copy of the IRP Billing Notice validated by

describing the operation, the vehicle and its intended use.

TXDOT.

Back to Front

1

1 2

2