Form St-121.3 - Exempt Use Certificate For Computer System Hardware - New York State And Local Sales And Use Tax

ADVERTISEMENT

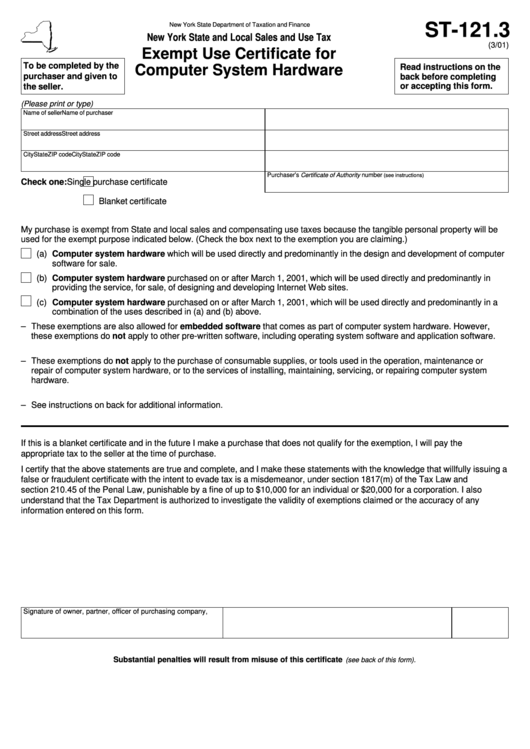

New York State Department of Taxation and Finance

ST-121.3

New York State and Local Sales and Use Tax

(3/01)

Exempt Use Certificate for

To be completed by the

Read instructions on the

Computer System Hardware

purchaser and given to

back before completing

or accepting this form.

the seller.

(Please print or type)

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Purchaser’s Certificate of Authority number

(see instructions)

Check one:

Single purchase certificate

Blanket certificate

My purchase is exempt from State and local sales and compensating use taxes because the tangible personal property will be

used for the exempt purpose indicated below. (Check the box next to the exemption you are claiming.)

(a) Computer system hardware which will be used directly and predominantly in the design and development of computer

software for sale.

(b) Computer system hardware purchased on or after March 1, 2001, which will be used directly and predominantly in

providing the service, for sale, of designing and developing Internet Web sites.

(c) Computer system hardware purchased on or after March 1, 2001, which will be used directly and predominantly in a

combination of the uses described in (a) and (b) above.

– These exemptions are also allowed for embedded software that comes as part of computer system hardware. However,

these exemptions do not apply to other pre-written software, including operating system software and application software.

– These exemptions do not apply to the purchase of consumable supplies, or tools used in the operation, maintenance or

repair of computer system hardware, or to the services of installing, maintaining, servicing, or repairing computer system

hardware.

– See instructions on back for additional information.

If this is a blanket certificate and in the future I make a purchase that does not qualify for the exemption, I will pay the

appropriate tax to the seller at the time of purchase.

I certify that the above statements are true and complete, and I make these statements with the knowledge that willfully issuing a

false or fraudulent certificate with the intent to evade tax is a misdemeanor, under section 1817(m) of the Tax Law and

section 210.45 of the Penal Law, punishable by a fine of up to $10,000 for an individual or $20,000 for a corporation. I also

understand that the Tax Department is authorized to investigate the validity of exemptions claimed or the accuracy of any

information entered on this form.

Signature of owner, partner, officer of purchasing company, etc.

Print name and title

Date

Substantial penalties will result from misuse of this certificate

(see back of this form).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1