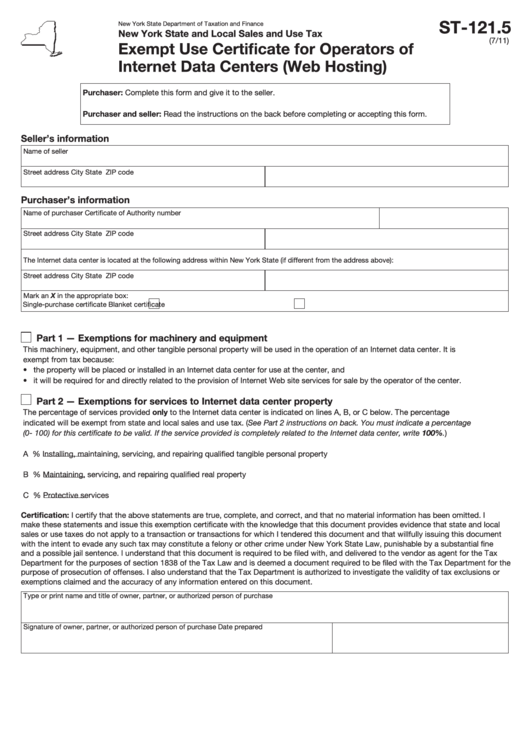

ST-121.5

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

(7/11)

Exempt Use Certificate for Operators of

Internet Data Centers (Web Hosting)

Purchaser: Complete this form and give it to the seller.

Purchaser and seller: Read the instructions on the back before completing or accepting this form.

Seller’s information

Name of seller

Street address

City

State

ZIP code

Purchaser’s information

Name of purchaser

Certificate of Authority number

Street address

City

State

ZIP code

The Internet data center is located at the following address within New York State (if different from the address above):

Street address

City

State

ZIP code

Mark an X in the appropriate box:

Single-purchase certificate

Blanket certificate

Part 1 — Exemptions for machinery and equipment

This machinery, equipment, and other tangible personal property will be used in the operation of an Internet data center. It is

exempt from tax because:

• the property will be placed or installed in an Internet data center for use at the center, and

• it will be required for and directly related to the provision of Internet Web site services for sale by the operator of the center.

Part 2 — Exemptions for services to Internet data center property

The percentage of services provided only to the Internet data center is indicated on lines A, B, or C below. The percentage

indicated will be exempt from state and local sales and use tax. (See Part 2 instructions on back. You must indicate a percentage

(0- 100) for this certificate to be valid. If the service provided is completely related to the Internet data center, write 100%.)

A

%

Installing, maintaining, servicing, and repairing qualified tangible personal property

B

%

Maintaining, servicing, and repairing qualified real property

C

%

Protective services

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I

make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local

sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document

with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine

and a possible jail sentence. I understand that this document is required to be filed with, and delivered to the vendor as agent for the Tax

Department for the purposes of section 1838 of the Tax Law and is deemed a document required to be filed with the Tax Department for the

purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or

exemptions claimed and the accuracy of any information entered on this document.

Type or print name and title of owner, partner, or authorized person of purchase

Signature of owner, partner, or authorized person of purchase

Date prepared

1

1 2

2