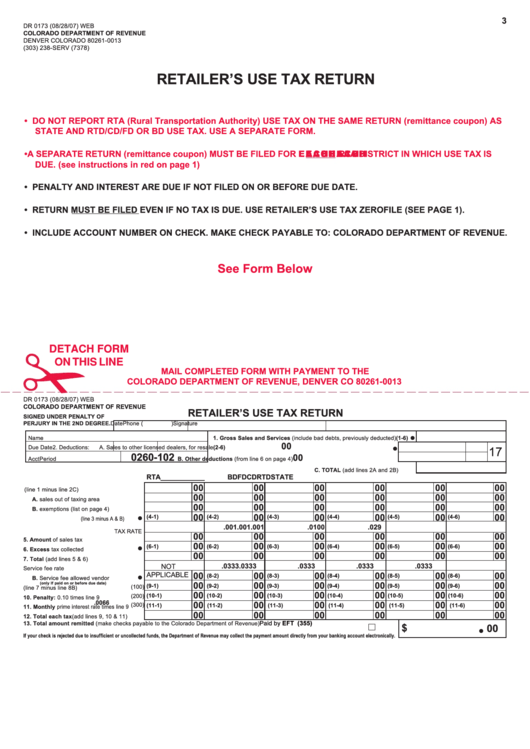

Form Dr 0173 - Retailer'S Use Tax Return

ADVERTISEMENT

3

DR 0173 (08/28/07) WEB

COLORADO DEPARTMENT OF REVENUE

DENVER COLORADO 80261-0013

(303) 238-SERV (7378)

RETAILER’S USE TAX RETURN

• DO NOT REPORT RTA (Rural Transportation Authority) USE TAX ON THE SAME RETURN (remittance coupon) AS

STATE AND RTD/CD/FD OR BD USE TAX. USE A SEPARATE FORM.

E A C H

E A C H

• A SEPARATE RETURN (remittance coupon) MUST BE FILED FOR E A C H

E A C H

E A C H RTA DISTRICT IN WHICH USE TAX IS

DUE. (see instructions in red on page 1)

• PENALTY AND INTEREST ARE DUE IF NOT FILED ON OR BEFORE DUE DATE.

• RETURN MUST BE FILED EVEN IF NO TAX IS DUE. USE RETAILER’S USE TAX ZEROFILE (SEE PAGE 1).

• INCLUDE ACCOUNT NUMBER ON CHECK. MAKE CHECK PAYABLE TO: COLORADO DEPARTMENT OF REVENUE.

See Form Below

DETACH FORM

ON THIS LINE

MAIL COMPLETED FORM WITH PAYMENT TO THE

COLORADO DEPARTMENT OF REVENUE, DENVER CO 80261-0013

DR 0173 (08/28/07) WEB

COLORADO DEPARTMENT OF REVENUE

RETAILER’S USE TAX RETURN

SIGNED UNDER PENALTY OF

PERJURY IN THE 2ND DEGREE. Date

Phone (

)

Signature

•

Name

1. Gross Sales and Services (include bad debts, previously deducted)

(1-6)

•

00

Due Date

2. Deductions:

A. Sales to other licensed dealers, for resale

(2-6)

17

0260-102

00

Acct

Period

B. Other deductions (from line 6 on page 4) .............

C. TOTAL (add lines 2A and 2B) ..........

RTA___________

BD

FD

CD

RTD

STATE

00

00

00

00

00

00

3. NET SALES (line 1 minus line 2C) .............

00

00

00

00

00

00

A. sales out of taxing area ...........................

00

00

00

00

00

00

B. exemptions (list on page 4) .....................

•

00

00

00

00

00

00

(4-1)

(4-2)

(4-3)

(4-4)

(4-5)

(4-6)

4. Net taxable sales (line 3 minus A & B) .............

.001

.001

.001

.0100

.029

TAX RATE

00

00

00

00

00

00

5. Amount of sales tax .....................................

•

00

00

00

00

00

00

(6-1)

(6-2)

(6-3)

(6-4)

(6-5)

(6-6)

6. Excess tax collected ....................................

00

00

00

00

00

00

7. Total (add lines 5 & 6) ..................................

.0333

.0333

.0333

.0333

.0333

NOT

8. A. Service fee rate .......................................

•

APPLICABLE

00

00

00

00

00

00

(8-2)

(8-3)

(8-4)

(8-5)

(8-6)

B. Service fee allowed vendor .....................

(only if paid on or before due date)

00

00

00

00

00

00

(9-1)

(9-2)

(9-3)

(9-4)

(9-5)

(9-6)

(100)

9. Sales Tax Due (line 7 minus line 8B) .........

00

00

00

00

00

00

(10-1)

(10-2)

(10-3)

(10-4)

(10-5)

(10-6)

(200)

10. Penalty: 0.10 times line 9 ..........................

.0066

00

00

00

00

00

00

(300)

(11-1)

(11-2)

(11-3)

(11-4)

(11-5)

(11-6)

11. Monthly prime interest rate times line 9 .........

00

00

00

00

00

00

12. Total each tax(add lines 9, 10 & 11) .........

$

Paid by EFT

(355)

00

13. Total amount remitted (make checks payable to the Colorado Department of Revenue) ...........................................

•

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your banking account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3