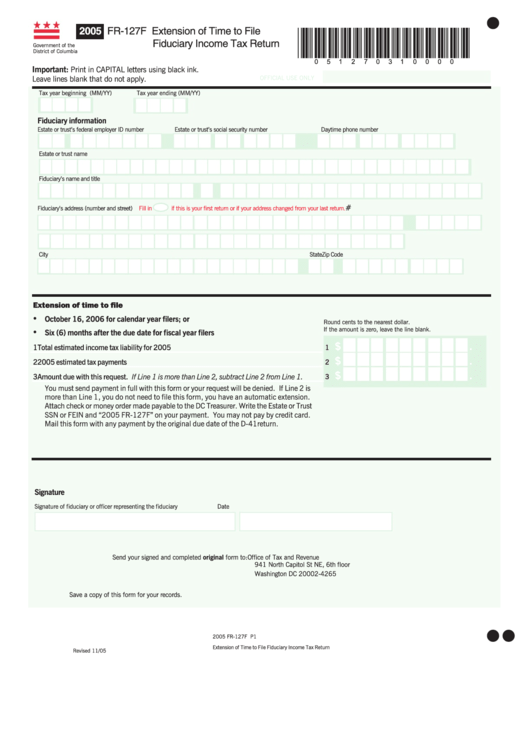

Form Fr-127f - Extension Of Time To File Fiduciary Income Tax Return November 2005

ADVERTISEMENT

2005

FR-127F Extension of Time to File

*051270310000*

Fiduciary Income Tax Return

Government of the

District of Columbia

Important:

Print in CAPITAL letters using black ink.

Leave lines blank that do not apply.

OFFICIAL USE ONLY

Tax year beginning (MM/YY)

Tax year ending (MM/YY)

Fiduciary information

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Daytime phone number

Estate or trust name

Fiduciary’s name and title

#

Fiduciary’s address (number and street)

Fill in

if this is your first return or if your address changed from your last return.

City

State

Zip Code

Extension of time to file

•

October 16, 2006 for calendar year filers; or

Round cents to the nearest dollar.

If the amount is zero, leave the line blank.

•

Six (6) months after the due date for fiscal year filers

$

.00

1 Total estimated income tax liability for 2005

1

$

.00

2 2005 estimated tax payments

2

$

.00

3 Amount due with this request. If Line 1 is more than Line 2, subtract Line 2 from Line 1.

3

You must send payment in full with this form or your request will be denied. If Line 2 is

more than Line 1, you do not need to file this form, you have an automatic extension.

Attach check or money order made payable to the DC Treasurer. Write the Estate or Trust

SSN or FEIN and “2005 FR-127F” on your payment. You may not pay by credit card.

Mail this form with any payment by the original due date of the D-41return.

Signature

Signature of fiduciary or officer representing the fiduciary

Date

Send your signed and completed original form to:

Office of Tax and Revenue

941 North Capitol St NE, 6th floor

Washington DC 20002-4265

Save a copy of this form for your records.

2005 FR-127F P1

Extension of Time to File Fiduciary Income Tax Return

Revised 11/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1