Form Mw-1 - Withholding Tax Reconciliation Form

ADVERTISEMENT

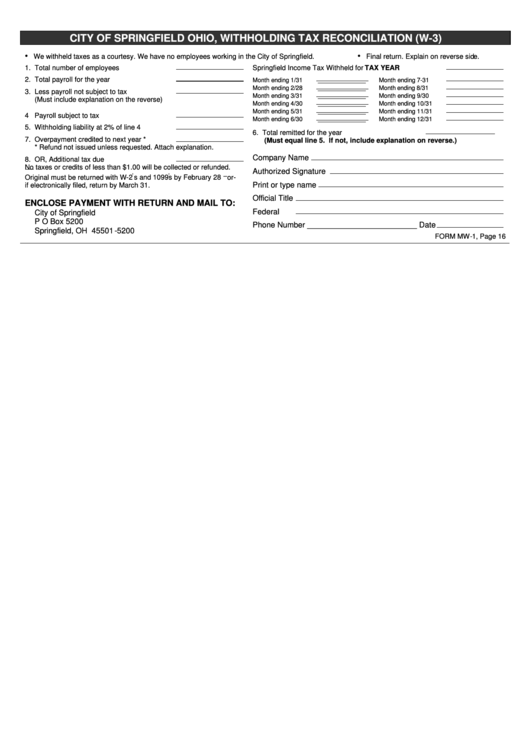

CITY OF SPRINGFIELD OHIO, WITHHOLDING TAX RECONCILIATION (W-3)

•

•

We withheld taxes as a courtesy. We have no employees working in the City of Springfield.

Final return. Explain on reverse side.

1. Total number of employees ......................

Springfield Income Tax Withheld for TAX YEAR .........

2. Total payroll for the year ...........................

Month ending 1/31....... ______________

Month ending 7-31 ........

Month ending 2/28....... ______________

Month ending 8/31 ........

3. Less payroll not subject to tax ..................

Month ending 3/31....... ______________

Month ending 9/30 ........

(Must include explanation on the reverse)

Month ending 4/30....... ______________

Month ending 10/31 .......

Month ending 5/31....... ______________

Month ending 11/31 .......

4 Payroll subject to tax ................................

Month ending 6/30....... ______________

Month ending 12/31 .......

5. Withholding liability at 2% of line 4 ...........

6. Total remitted for the year ......................................

7. Overpayment credited to next year * ........

(Must equal line 5. If not, include explanation on reverse.)

* Refund not issued unless requested. Attach explanation.

Company Name

8. OR, Additional tax due ..............................

No taxes or credits of less than $1.00 will be collected or refunded.

Authorized Signature

Original must be returned with W-2 s and 1099 s by February 28 or-

Print or type name

if electronically filed, return by March 31.

Official Title

ENCLOSE PAYMENT WITH RETURN AND MAIL TO:

Federal I.D.

City of Springfield

P O Box 5200

Phone Number _________________________ Date

Springfield, OH 45501-5200

FORM MW-1, Page 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1