Form Mw-3 - Montana Annual Withholding Tax Reconciliation Instructions

ADVERTISEMENT

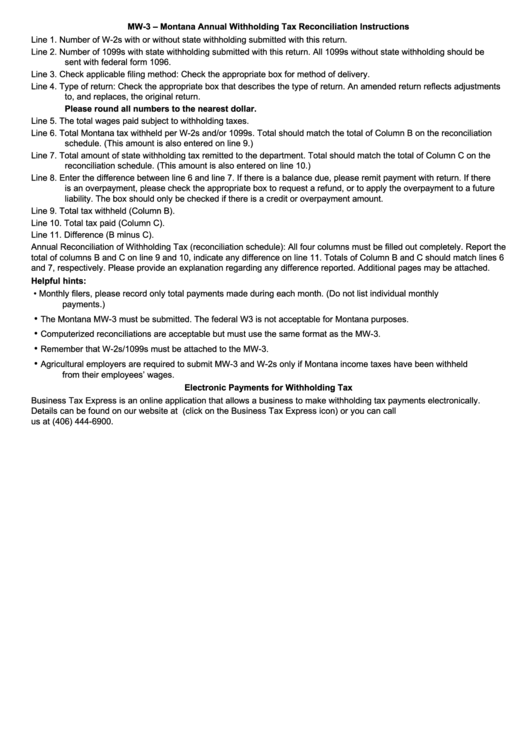

MW-3 – Montana Annual Withholding Tax Reconciliation Instructions

Line 1. Number of W-2s with or without state withholding submitted with this return.

Line 2. Number of 1099s with state withholding submitted with this return. All 1099s without state withholding should be

sent with federal form 1096.

Line 3. Check applicable filing method: Check the appropriate box for method of delivery.

Line 4. Type of return: Check the appropriate box that describes the type of return. An amended return reflects adjustments

to, and replaces, the original return.

Please round all numbers to the nearest dollar.

Line 5. The total wages paid subject to withholding taxes.

Line 6. Total Montana tax withheld per W-2s and/or 1099s. Total should match the total of Column B on the reconciliation

schedule. (This amount is also entered on line 9.)

Line 7. Total amount of state withholding tax remitted to the department. Total should match the total of Column C on the

reconciliation schedule. (This amount is also entered on line 10.)

Line 8. Enter the difference between line 6 and line 7. If there is a balance due, please remit payment with return. If there

is an overpayment, please check the appropriate box to request a refund, or to apply the overpayment to a future

liability. The box should only be checked if there is a credit or overpayment amount.

Line 9. Total tax withheld (Column B).

Line 10. Total tax paid (Column C).

Line 11. Difference (B minus C).

Annual Reconciliation of Withholding Tax (reconciliation schedule): All four columns must be filled out completely. Report the

total of columns B and C on line 9 and 10, indicate any difference on line 11. Totals of Column B and C should match lines 6

and 7, respectively. Please provide an explanation regarding any difference reported. Additional pages may be attached.

Helpful hints:

•

Monthly filers, please record only total payments made during each month. (Do not list individual monthly

payments.)

•

The Montana MW-3 must be submitted. The federal W3 is not acceptable for Montana purposes.

•

Computerized reconciliations are acceptable but must use the same format as the MW-3.

•

Remember that W-2s/1099s must be attached to the MW-3.

•

Agricultural employers are required to submit MW-3 and W-2s only if Montana income taxes have been withheld

from their employees’ wages.

Electronic Payments for Withholding Tax

Business Tax Express is an online application that allows a business to make withholding tax payments electronically.

Details can be found on our website at (click on the Business Tax Express icon) or you can call

us at (406) 444-6900.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1