-

-

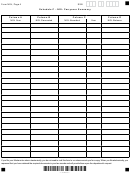

Form NOL, Page 3

SSN

Schedule B - NOL Carryback/Carryforward (continued)

Complete one column before going to the next

2014 NOL applied to

2014 NOL applied to

2014 NOL applied to

column. See instructions.

tax year ________

tax year ________

tax year ________

28. Casualty and theft losses from federal Form

4684, line 18 (line 23 for 2008; line 21 for

2009; line 20 for 2005, 2006 and 2010) (or as

previously adjusted).

29. Casualty and theft losses from federal Form

4684, line 16 (line 18 for 2005, 2006 and

2010; line 21 for 2008; line 19 for 2009) (or as

previously adjusted).

30. Multiply line 22 by 10% (0.10).

31. Subtract line 30 from line 29. If zero or less,

enter zero.

32. Subtract line 31 from line 28.

33. Miscellaneous itemized deductions from Form

2, Schedule III, line 26.

34. Miscellaneous itemized deductions from Form

2, Schedule III, line 23.

35. Multiply line 22 by 2% (0.02).

36. Subtract line 35 from line 34. If zero or less,

enter zero.

37. Subtract line 36 from line 33.

38. Complete the worksheet in the instructions

if line 22 is more than the applicable amount

shown in the instructions.

Otherwise, combine lines 18, 21, 27, 32 and 37;

enter the result here and on line 7 (page 2).

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*14DN0301*

*14DN0301*

1

1 2

2 3

3 4

4