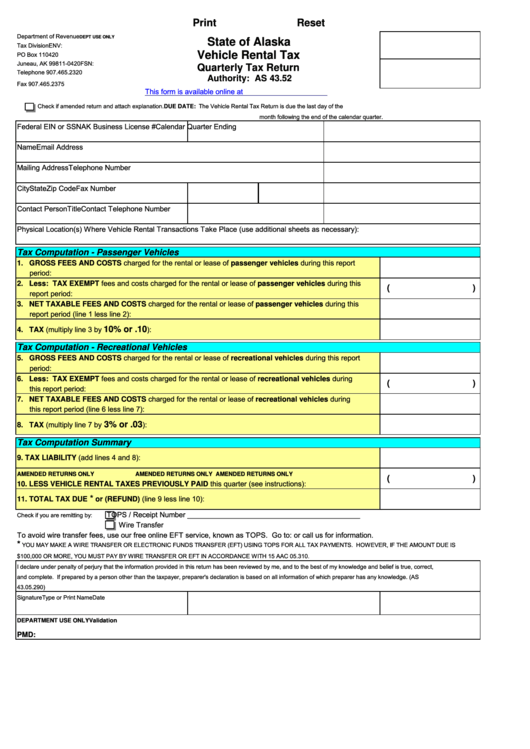

Print

Reset

Department of Revenue

DEPT USE ONLY

State of Alaska

Tax Division

ENV:

Vehicle Rental Tax

PO Box 110420

Juneau, AK 99811-0420

FSN:

Quarterly Tax Return

Telephone 907.465.2320

Authority: AS 43.52

Fax 907.465.2375

This form is available online at

Check if amended return and attach explanation.

DUE DATE: The Vehicle Rental Tax Return is due the last day of the

month following the end of the calendar quarter.

Federal EIN or SSN

AK Business License #

Calendar Quarter Ending

Name

Email Address

Mailing Address

Telephone Number

City

State

Zip Code

Fax Number

Contact Person

Title

Contact Telephone Number

Physical Location(s) Where Vehicle Rental Transactions Take Place (use additional sheets as necessary):

Tax Computation - Passenger Vehicles

1. GROSS FEES AND COSTS charged for the rental or lease of passenger vehicles during this report

period:

2. Less: TAX EXEMPT fees and costs charged for the rental or lease of passenger vehicles during this

(

)

report period:

3. NET TAXABLE FEES AND COSTS charged for the rental or lease of passenger vehicles during this

report period (line 1 less line 2):

4. TAX (multiply line 3 by

):

10% or .10

Tax Computation - Recreational Vehicles

5. GROSS FEES AND COSTS charged for the rental or lease of recreational vehicles during this report

period:

6. Less: TAX EXEMPT fees and costs charged for the rental or lease of recreational vehicles during

(

)

this report period:

7. NET TAXABLE FEES AND COSTS charged for the rental or lease of recreational vehicles during

this report period (line 6 less line 7):

8. TAX (multiply line 7 by

):

3% or .03

Tax Computation Summary

9. TAX LIABILITY (add lines 4 and 8):

AMENDED RETURNS ONLY

AMENDED RETURNS ONLY

AMENDED RETURNS ONLY

(

)

10. LESS VEHICLE RENTAL TAXES PREVIOUSLY PAID this quarter (see instructions):

*

or (REFUND) (line 9 less line 10):

11. TOTAL TAX DUE

TOPS / Receipt Number ___________________________________________

Check if you are remitting by:

Wire Transfer

To avoid wire transfer fees, use our free online EFT service, known as TOPS. Go to:

https://

or call us for information.

*

YOU MAY MAKE A WIRE TRANSFER OR ELECTRONIC FUNDS TRANSFER (EFT) USING TOPS FOR ALL TAX PAYMENTS. HOWEVER, IF THE AMOUNT DUE IS

$100,000 OR MORE, YOU MUST PAY BY WIRE TRANSFER OR EFT IN ACCORDANCE WITH 15 AAC 05.310.

I declare under penalty of perjury that the information provided in this return has been reviewed by me, and to the best of my knowledge and belief is true, correct,

and complete. If prepared by a person other than the taxpayer, preparer's declaration is based on all information of which preparer has any knowledge. (AS

43.05.290)

Signature

Type or Print Name

Date

DEPARTMENT USE ONLY

Validation

PMD:

1

1