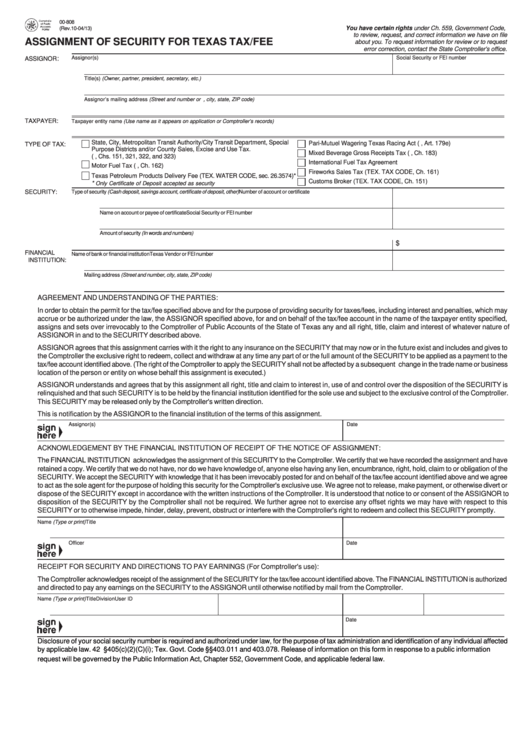

00-808

You have certain rights under Ch. 559, Government Code,

(Rev.10-04/13)

to review, request, and correct information we have on file

ASSIGNMENT OF SECURITY FOR TEXAS TAX/FEE

about you. To request information for review or to request

error correction, contact the State Comptroller's office.

:

Assignor(s)

Social Security or FEI number

ASSIGNOR

Title(s) (Owner, partner, president, secretary, etc.)

Assignor’s mailing address (Street and number or P.O. box, city, state, ZIP code)

TAXPAYER:

Taxpayer entity name (Use name as it appears on application or Comptroller’s records)

State, City, Metropolitan Transit Authority/City Transit Department, Special

Pari-Mutuel Wagering Texas Racing Act (TEX.REV.CIV.STAT., Art. 179e)

TYPE OF TAX:

Purpose Districts and/or County Sales, Excise and Use Tax.

Mixed Beverage Gross Receipts Tax (TEX.TAX CODE, Ch. 183)

(TEX.TAX CODE, Chs. 151, 321, 322, and 323)

International Fuel Tax Agreement

Motor Fuel Tax (TEX.TAX CODE, Ch. 162)

Fireworks Sales Tax (TEX. TAX CODE, Ch. 161)

Texas Petroleum Products Delivery Fee (TEX. WATER CODE, sec. 26.3574)*

Customs Broker (TEX. TAX CODE, Ch. 151)

*

Only Certificate of Deposit accepted as security

SECURITY:

Type of security (Cash deposit, savings account, certificate of deposit, other)

Number of account or certificate

Name on account or payee of certificate

Social Security or FEI number

Amount of security (In words and numbers)

$

FINANCIAL

Name of bank or financial institution

Texas Vendor or FEI number

INSTITUTION:

Mailing address (Street and number, city, state, ZIP code)

AGREEMENT AND UNDERSTANDING OF THE PARTIES:

In order to obtain the permit for the tax/fee specified above and for the purpose of providing security for taxes/fees, including interest and penalties, which may

accrue or be authorized under the law, the ASSIGNOR specified above, for and on behalf of the tax/fee account in the name of the taxpayer entity specified,

assigns and sets over irrevocably to the Comptroller of Public Accounts of the State of Texas any and all right, title, claim and interest of whatever nature of

ASSIGNOR in and to the SECURITY described above.

ASSIGNOR agrees that this assignment carries with it the right to any insurance on the SECURITY that may now or in the future exist and includes and gives to

the Comptroller the exclusive right to redeem, collect and withdraw at any time any part of or the full amount of the SECURITY to be applied as a payment to the

tax/fee account identified above. (The right of the Comptroller to apply the SECURITY shall not be affected by a subsequent change in the trade name or business

location of the person or entity on whose behalf this assignment is executed.)

ASSIGNOR understands and agrees that by this assignment all right, title and claim to interest in, use of and control over the disposition of the SECURITY is

relinquished and that such SECURITY is to be held by the financial institution identified for the sole use and subject to the exclusive control of the Comptroller.

This SECURITY may be released only by the Comptroller's written direction.

This is notification by the ASSIGNOR to the financial institution of the terms of this assignment.

Assignor(s)

Date

ACKNOWLEDGEMENT BY THE FINANCIAL INSTITUTION OF RECEIPT OF THE NOTICE OF ASSIGNMENT:

The FINANCIAL INSTITUTION acknowledges the assignment of this SECURITY to the Comptroller. We certify that we have recorded the assignment and have

retained a copy. We certify that we do not have, nor do we have knowledge of, anyone else having any lien, encumbrance, right, hold, claim to or obligation of the

SECURITY. We accept the SECURITY with knowledge that it has been irrevocably posted for and on behalf of the tax/fee account identified above and we agree

to act as the sole agent for the purpose of holding this security for the Comptroller's exclusive use. We agree not to release, make payment, or otherwise divert or

dispose of the SECURITY except in accordance with the written instructions of the Comptroller. It is understood that notice to or consent of the ASSIGNOR to

disposition of the SECURITY by the Comptroller shall not be required. We further agree not to exercise any offset rights we may have with respect to this

SECURITY or to otherwise impede, hinder, delay, prevent, obstruct or interfere with the Comptroller's right to redeem and collect this SECURITY promptly.

Name (Type or print)

Title

Officer

Date

RECEIPT FOR SECURITY AND DIRECTIONS TO PAY EARNINGS (For Comptroller's use):

The Comptroller acknowledges receipt of the assignment of the SECURITY for the tax/fee account identified above. The FINANCIAL INSTITUTION is authorized

and directed to pay any earnings on the SECURITY to the ASSIGNOR until otherwise notified by mail from the Comptroller.

Name (Type or print)

Title

Division

User ID

Date

Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected

by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information

request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

1

1