Form 1040-Mj - Hudson Individual Income Tax Return - Income Tax Division

ADVERTISEMENT

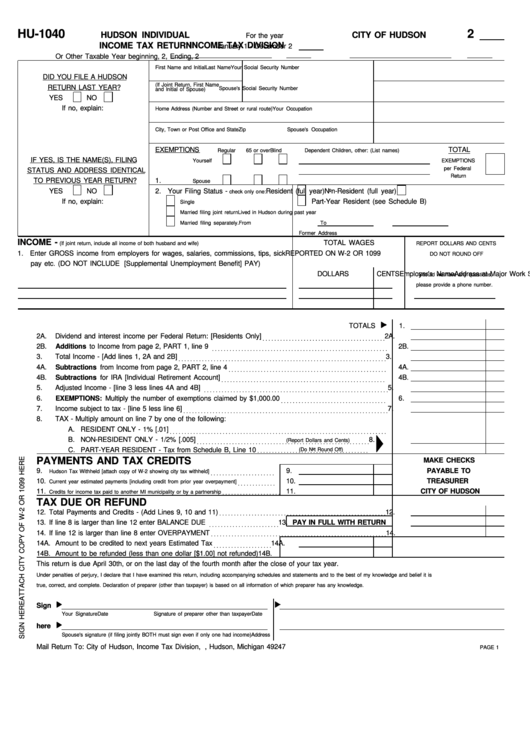

HU-1040

2

HUDSON INDIVIDUAL

CITY OF HUDSON

For the year

INCOME TAX RETURN

INCOME TAX DIVISION

January 1 - December 2

Or Other Taxable Year beginning

, 2

, Ending

, 2

First Name and Initial

Last Name

Your Social Security Number

DID YOU FILE A HUDSON

(If Joint Return, First Name

RETURN LAST YEAR?

Spouse's Social Security Number

and Initial of Spouse)

YES

NO

If no, explain:

Home Address (Number and Street or rural route)

Your Occupation

City, Town or Post Office and State

Zip

Spouse's Occupation

EXEMPTIONS

TOTAL

Regular

65 or over

Blind

Dependent Children, other: (List names)

IF YES, IS THE NAME(S), FILING

Yourself

EXEMPTIONS

per Federal

STATUS AND ADDRESS IDENTICAL

Return

TO PREVIOUS YEAR RETURN?

1.

Spouse

YES

NO

2. Your Filing Status -

Resident (full year)

Non-Resident (full year)

check only one:

If no, explain:

Part-Year Resident (see Schedule B)

Single

Married filing joint return

Lived in Hudson during past year

Married filing separately.

From

To

Former Address

INCOME -

TOTAL WAGES

(If joint return, include all income of both husband and wife)

REPORT DOLLARS AND CENTS

1. Enter GROSS income from employers for wages, salaries, commissions, tips, sick

REPORTED ON W-2 OR 1099

DO NOT ROUND OFF

pay etc. (DO NOT INCLUDE S.U.B. [Supplemental Unemployment Benefit] PAY)

Employer's Name

Address at Major Work Site

DOLLARS

CENTS

Should we have any questions,

please provide a phone number.

TOTALS

1.

2A.

Dividend and interest income per Federal Return: [Residents Only]

2A.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2B.

Additions to Income from page 2, PART 1, line 9

2B.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Total Income - [Add lines 1, 2A and 2B]

3.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4A.

Subtractions from Income from page 2, PART 2, line 4

4A.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4B.

Subtractions for IRA [Individual Retirement Account]

4B.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Adjusted Income - [line 3 less lines 4A and 4B]

5.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

EXEMPTIONS: Multiply the number of exemptions claimed by $1,000.00

6.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Income subject to tax - [line 5 less line 6]

7.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

TAX - Multiply amount on line 7 by one of the following:

A. RESIDENT ONLY - 1% [.01]

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. NON-RESIDENT ONLY - 1/2% [.005]

8.

(Report Dollars and Cents)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C. PART-YEAR RESIDENT - Tax from Schedule B, Line 10

(Do Not Round Off)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PAYMENTS AND TAX CREDITS

MAKE CHECKS

9.

9.

PAYABLE TO

Hudson Tax Withheld [attach copy of W-2 showing city tax withheld] . . . . . . . . . . . . . . . . . . . . . .

10.

10.

TREASURER

Current year estimated payments [including credit from prior year overpayment] . . . . . . . . . . . . .

11.

11.

CITY OF HUDSON

Credits for income tax paid to another MI municipality or by a partnership . . . . . . . . . . . . . . . . . . . .

TAX DUE OR REFUND

12. Total Payments and Credits - (Add Lines 9, 10 and 11)

12.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. If line 8 is larger than line 12 enter BALANCE DUE

PAY IN FULL WITH RETURN

13.

. . . . . . . . . . . . . . . . . . . . . . . .

14. If line 12 is larger than line 8 enter OVERPAYMENT

14.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14A. Amount to be credited to next years Estimated Tax

14A.

. . . . . . . . . . . . . . . . . . . .

14B. Amount to be refunded (less than one dollar [$1.00] not refunded)

14B.

This return is due April 30th, or on the last day of the fourth month after the close of your tax year.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the best of my knowledge and belief it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Your Signature

Date

Signature of preparer other than taxpayer

Date

here

Spouse's signature (if filing jointly BOTH must sign even if only one had income)

Address

Mail Return To: City of Hudson, Income Tax Division, P.O. Box 231, Hudson, Michigan 49247

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2