Form Op-337 - Tourism Account Surcharge Return

ADVERTISEMENT

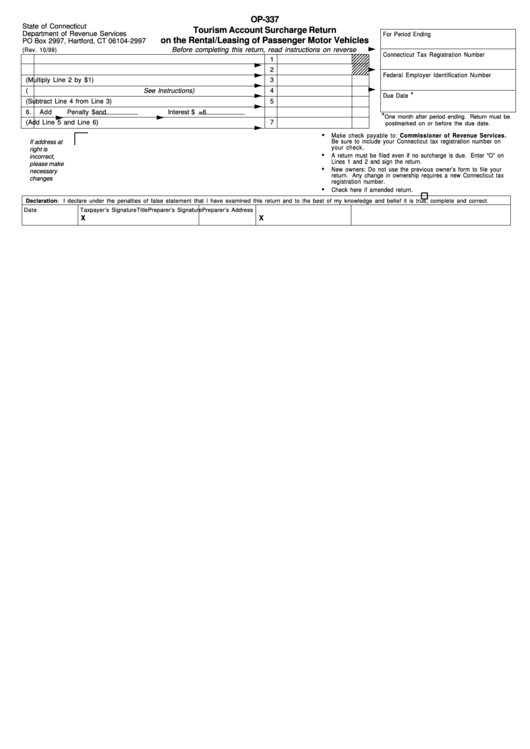

OP-337

State of Connecticut

Tourism Account Surcharge Return

Department of Revenue Services

For Period Ending

on the Rental/Leasing of Passenger Motor Vehicles

PO Box 2997, Hartford, CT 06104-2997

Before completing this return, read instructions on reverse

(Rev. 10/99)

1 2 3 4 5 6

1 2 3 4 5 6

Connecticut Tax Registration Number

1 2 3 4 5 6

1.

Number of passenger motor vehicles subject to surcharge

1

1 2 3 4 5 6

1 2 3 4 5 6

1 2 3 4 5 6

1 2 3 4 5 6

2.

Total number of days vehicles from Line 1 were rented/leased

2

1 2 3 4 5 6

1 2 3 4 5 6

Federal Employer Identification Number

3.

Amount of surcharge due (Multiply Line 2 by $1)

3

4.

Credit for uncollectible accounts ( See Instructions)

4

*

Due Date

5.

Net surcharge due (Subtract Line 4 from Line 3)

5

6.

Add

Penalty $

and

Interest $

=

6

*

One month after period ending. Return must be

7.

Total amount due (Add Line 5 and Line 6)

7

postmarked on or before the due date.

•

Make check payable to: Commissioner of Revenue Services.

Be sure to include your Connecticut tax registration number on

If address at

your check.

right is

•

A return must be filed even if no surcharge is due. Enter “O” on

incorrect,

Lines 1 and 2 and sign the return.

please make

•

New owners: Do not use the previous owner’s form to file your

necessary

return. Any change in ownership requires a new Connecticut tax

changes

registration number.

•

Check here if amended return.

Declaration: I declare under the penalties of false statement that I have examined this return and to the best of my knowledge and belief it is true, complete and correct.

Date

Taxpayer’s Signature

Title

Preparer’s Signature

Preparer’s Address

X

X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1