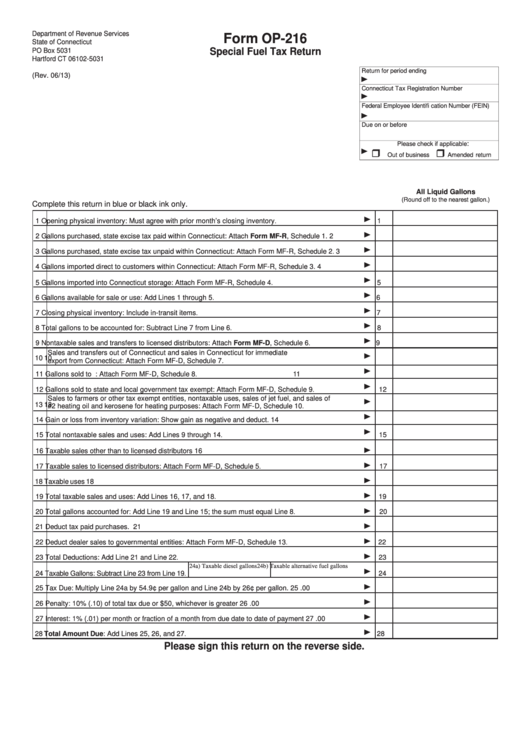

Department of Revenue Services

Form OP-216

State of Connecticut

PO Box 5031

Special Fuel Tax Return

Hartford CT 06102-5031

Return for period ending

(Rev. 06/13)

Connecticut Tax Registration Number

Federal Employee Identifi cation Number (FEIN)

Due on or before

:

Please check if applicable

Out of business

Amended return

All Liquid Gallons

(Round off to the nearest gallon.)

Complete this return in blue or black ink only.

1

Opening physical inventory: Must agree with prior month’s closing inventory

1

.

2

Gallons purchased, state excise tax paid within Connecticut: Attach Form MF-R, Schedule 1.

2

3

Gallons purchased, state excise tax unpaid within Connecticut: Attach Form MF-R, Schedule 2

3

.

4

Gallons imported direct to customers within Connecticut: Attach Form MF-R, Schedule 3.

4

5

Gallons imported into Connecticut storage: Attach Form MF-R, Schedule 4

5

.

6

Gallons available for sale or use: Add Lines 1 through 5

6

.

7

Closing physical inventory: Include in-transit items

7

.

8

Total gallons to be accounted for: Subtract Line 7 from Line 6

8

.

9

Nontaxable sales and transfers to licensed distributors: Attach Form MF-D, Schedule 6

9

.

Sales and transfers out of Connecticut and sales in Connecticut for immediate

10

10

export from Connecticut: Attach Form MF-D, Schedule 7.

11 Gallons sold to U.S. government tax exempt: Attach Form MF-D, Schedule 8

11

.

12 Gallons sold to state and local government tax exempt: Attach Form MF-D, Schedule 9

12

.

Sales to farmers or other tax exempt entities, nontaxable uses, sales of jet fuel, and sales of

13

13

#2 heating oil and kerosene for heating purposes: Attach Form MF-D, Schedule 10

.

14 Gain or loss from inventory variation: Show gain as negative and deduct.

14

15 Total nontaxable sales and uses: Add Lines 9 through 14

15

.

16 Taxable sales other than to licensed distributors

16

17 Taxable sales to licensed distributors: Attach Form MF-D, Schedule 5

17

.

18 Taxable uses

18

19 Total taxable sales and uses: Add Lines 16, 17, and 18

19

.

20 Total gallons accounted for: Add Line 19 and Line 15; the sum must equal Line 8

20

.

21 Deduct tax paid purchases.

21

22 Deduct dealer sales to governmental entities: Attach Form MF-D, Schedule 13

22

.

23 Total Deductions: Add Line 21 and Line 22

23

.

24a) Taxable diesel gallons

24b) Taxable alternative fuel gallons

24 Taxable Gallons: Subtract Line 23 from Line 19

24

.

25 Tax Due: Multiply Line 24a by 54.9¢ per gallon and Line 24b by 26¢ per gallon.

25

.00

26 Penalty: 10% (.10) of total tax due or $50, whichever is greater

26

.00

27 Interest: 1% (.01) per month or fraction of a month from due date to date of payment

27

.00

28 Total Amount Due: Add Lines 25, 26, and 27

28

.00

.

Please sign this return on the reverse side.

1

1 2

2 3

3