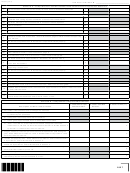

IT-541 (1/17)

LDR Account Number:

7A Less federal income tax deduction – Enter the amount from Schedule D, Line 19.

7A

7B Federal Disaster Relief Credits – See Instructions.

7B

8

Louisiana taxable income – Subtract Line 7A from Line 6.

8

Computation of Income

9

Total tax – See Worksheet 1 – Calculation of Income Tax

9

Resident only: Credit for net income taxes paid to other states by resident estates and trusts

10

10

– Completed Form R-10606 and a copy of the other state’s return must be submitted.

11 Other nonrefundable priority 1 income tax credits – From Schedule NRC-P1, Line 7

11

12 Total income tax after priority 1 credits – Subtract Lines 10 and 11 from Line 9.

12

13A Louisiana Citizens Insurance Assessment Paid

13A

13 Louisiana Citizens Insurance Credit – See instructions.

13

14 Other refundable priority 2 credits – From Schedule RC-P2, Line 9

14

15 Total priority 2 credits – Add Line 13 and Line 14.

15

16 Tax liability after priority 2 credits – See instructions.

16

17 Overpayment after priority 2 credits – See instructions.

17

18 Nonrefundable priority 3 credits from Schedule NRC-P3, Line 10

18

19 Tax after priority 3 credits – See instructions.

19

20 Overpayment after priority 2 credits – Enter the amount from Line 17.

20

21 Refundable priority 4 credits from Schedule RC-P4, Line 6

21

22 Amount of credit carried forward from 2015

22

Nonresident only: Amount paid on your behalf by a Composite Partnership Filing

23

23

Enter name of partnership ____________________________________________________

24 Amount of Louisiana Tax Withheld For 2016 – Attach Forms W-2 and 1099.

24

Amount of Estimated Payments for 2016 and Amount Paid with Extension Request – From

25

25

Schedule E, Line 6

26 Total Refundable Tax Credits and Payments – Add Lines 20 through 25.

26

Overpayment – If Line 26 is greater than Line 19, subtract Line 19 from Line 26. Otherwise,

27

27

go to Line 30.

28 Amount of Line 27 to be credited to 2017 Income tax

28

29 Amount to be refunded – Subtract Line 28 from Line 27

29

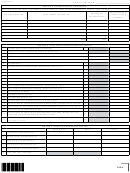

1822

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8