IT-541 (1/17)

_____________________________

LDR Account Number u

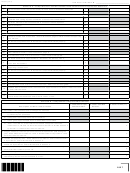

Schedule A – Computation of Louisiana Taxable Income before Income Distribution Deduction

1

Federal taxable income before the exemption and income distribution deduction

1

2

Net income taxes paid to any state or political or municipal subdivision

2

Subtractions

Any income that is exempt from taxation under the laws of Louisiana or that Louisiana is

3A

3A

prohibited from taxing by the Constitution or laws of the United States

3B

Depletion allowed under Louisiana law in excess of federal depletion

3B

3C

S-Bank exclusion

3C

4

Total subtractions - Add Lines 3A through 3C.

4

5

Modified federal taxable income - Add Lines 1 and 2, subtract Line 4 and enter the result.

5

Modified Federal Taxable Income Allocated or Apportioned to Louisiana

Allocable income from all sources – See instructions, page 6. Attach schedule supporting

6

6

each amount.

6A

Net rents and royalties from immovable or corporeal movable property

6A

6B

Royalties from the use of patents, trademarks, etc.

6B

6C

Income from estates, trusts, and partnerships

6C

6D

Income from construction, repair, etc.

6D

6E

Other allocable income – See instructions, page 6.

6E

6F

Total allocable income from all sources – Add Lines 6A through 6E.

6F

7

Net income subject to apportionment – Subtract Line 6F from Line 5.

7

Net income apportioned to Louisiana – Multiply Line 7 by the percentage from Schedule B,

8

8

Line 7. See instructions.

Allocable income from Louisiana sources – See instructions, page 6. Attach schedule

9

9

supporting each amount.

9A

Net rents and royalties from immovable or corporeal movable property

9A

9B

Royalties from the use of patents, trademarks, etc.

9B

9C

Income from estates, trusts, and partnerships

9C

9D

Income from construction, repair, etc.

9D

9E

Other allocable income – See instructions.

9E

9F

Total allocable income from Louisiana sources – Add Lines 9A through 9E.

9F

Modified federal taxable income allocated and apportioned to Louisiana – Add Line 8 and

10

10

9F and enter the result.

11

Less federal itemized deductions attributable to Louisiana - See instructions.

11

Louisiana taxable income before income distribution deduction - Subtract Line 11 from

12

12

Line 10. Enter the result here and on Form IT-541, Line 4.

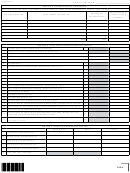

Schedule B – Computation of Apportionment Percent

1. Total amount per

2. Total Louisiana

3. Factor ratios (%)

Description of items used as factors

Federal Return

Amount

1. Net sales of merchandise and/or charges for services

A. Sales where goods, merchandise, or property is received in

Louisiana by the purchaser

B. Charges for services performed in Louisiana

C. Other gross apportionable income attributable to Louisiana

D. Total - In Column 1, enter total net sales and charges for services.

Add Lines 1A, 1B, and 1C. Enter the result in Column 2. Divide Column 2

%

by Column 1 and enter the ratio in Column 3.

2. Wages, salaries, and other personal service compensation paid during the

year. Enter amounts in Columns 1 and 2. Divide Column 2 by Column 1 and

%

enter the ratio in Column 3.

3. Income tax property ratio - Enter amounts in Column 1 and 2. Divide Column

%

2 by Column 1 and enter the ratio in Column 3.

4. Loans made during the year - Enter amounts in Columns 1 and 2. Divide

%

Column 2 by Column 1 and enter the ratio in Column 3.

5. Taxpayers primarily in the business of manufacturing and merchandising

%

enter ratio from Column 3, Line 1D.

6. Add percentages under Column 3, Lines 1D, 2, 3, 4, and 5 and enter result.

%

7. Average of percents - Line 6 divided by the number of factors used. Multiply

%

the result by the amount on Schedule A, Line 7.

1827

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8