Closing Or Sale Of Business Or Change Of Legal Entity - Florida, Information For Filing Form F-7004, Information For Filing F-1120es

ADVERTISEMENT

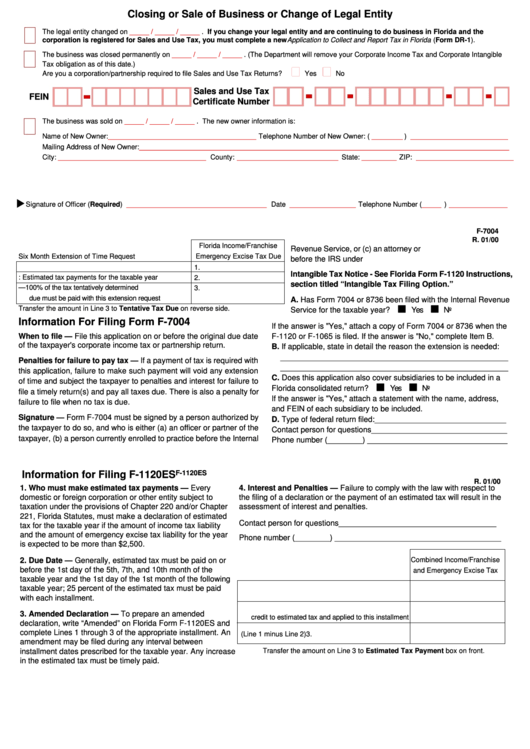

Closing or Sale of Business or Change of Legal Entity

The legal entity changed on

_____ / _____ / _____

. If you change your legal entity and are continuing to do business in Florida and the

corporation is registered for Sales and Use Tax, you must complete a new Application to Collect and Report Tax in Florida (Form DR-1).

The business was closed permanently on

_____ / _____ / _____

. (The Department will remove your Corporate Income Tax and Corporate Intangible

Tax obligation as of this date.)

Are you a corporation/partnership required to file Sales and Use Tax Returns?

Yes

No

Sales and Use Tax

FEIN

Certificate Number

The business was sold on

_____ / _____ / _____

. The new owner information is:

Name of New Owner:

______________________________________

Telephone Number of New Owner: (

________

)

_________________________

Mailing Address of New Owner:

_______________________________________________________________________________________________

City:

______________________________________

County:

__________________________

State:

_________

ZIP:

_________________________

Signature of Officer (Required)

____________________________________

Date

_________________

Telephone Number (

_____

)

_______________

F-7004

R. 01/00

Florida Income/Franchise

Revenue Service, or (c) an attorney or C.P.A. qualified to practice

Emergency Excise Tax Due

Six Month Extension of Time Request

before the IRS under P.L. 89-332.

1. Tentative amount of Florida tax for the taxable year

1.

Intangible Tax Notice - See Florida Form F-1120 Instructions,

2. LESS: Estimated tax payments for the taxable year

2.

section titled “Intangible Tax Filing Option.”

3. Balance due —100% of the tax tentatively determined

3.

due must be paid with this extension request

A. Has Form 7004 or 8736 been filed with the Internal Revenue

Transfer the amount in Line 3 to Tentative Tax Due on reverse side.

Service for the taxable year?

Yes

No

Information For Filing Form F-7004

If the answer is "Yes," attach a copy of Form 7004 or 8736 when the

When to file — File this application on or before the original due date

F-1120 or F-1065 is filed. If the answer is "No," complete Item B.

of the taxpayer's corporate income tax or partnership return.

B. If applicable, state in detail the reason the extension is needed:

____________________________________________________

Penalties for failure to pay tax — If a payment of tax is required with

____________________________________________________

this application, failure to make such payment will void any extension

C. Does this application also cover subsidiaries to be included in a

of time and subject the taxpayer to penalties and interest for failure to

Florida consolidated return?

Yes

No

file a timely return(s) and pay all taxes due. There is also a penalty for

If the answer is "Yes," attach a statement with the name, address,

failure to file when no tax is due.

and FEIN of each subsidiary to be included.

Signature — Form F-7004 must be signed by a person authorized by

D. Type of federal return filed: ______________________________

the taxpayer to do so, and who is either (a) an officer or partner of the

Contact person for questions_______________________________

taxpayer, (b) a person currently enrolled to practice before the Internal

Phone number (________) ________________________________

F-1120ES

Information for Filing F-1120ES

R. 01/00

1. Who must make estimated tax payments — Every

4. Interest and Penalties — Failure to comply with the law with respect to

domestic or foreign corporation or other entity subject to

the filing of a declaration or the payment of an estimated tax will result in the

taxation under the provisions of Chapter 220 and/or Chapter

assessment of interest and penalties.

221, Florida Statutes, must make a declaration of estimated

Contact person for questions ____________________________________

tax for the taxable year if the amount of income tax liability

and the amount of emergency excise tax liability for the year

Phone number (________) ______________________________________

is expected to be more than $2,500.

2. Due Date — Generally, estimated tax must be paid on or

Combined Income/Franchise

before the 1st day of the 5th, 7th, and 10th month of the

and Emergency Excise Tax

taxable year and the 1st day of the 1st month of the following

taxable year; 25 percent of the estimated tax must be paid

1. Amount of this installment

1.

with each installment.

2. Amount of overpayment from last year elected for

2.

3. Amended Declaration — To prepare an amended

credit to estimated tax and applied to this installment

declaration, write “Amended” on Florida Form F-1120ES and

complete Lines 1 through 3 of the appropriate installment. An

3. Amount of this payment (Line 1 minus Line 2)

3.

amendment may be filed during any interval between

Transfer the amount on Line 3 to Estimated Tax Payment box on front.

installment dates prescribed for the taxable year. Any increase

in the estimated tax must be timely paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1