Information For Filing For Form F-1120es

ADVERTISEMENT

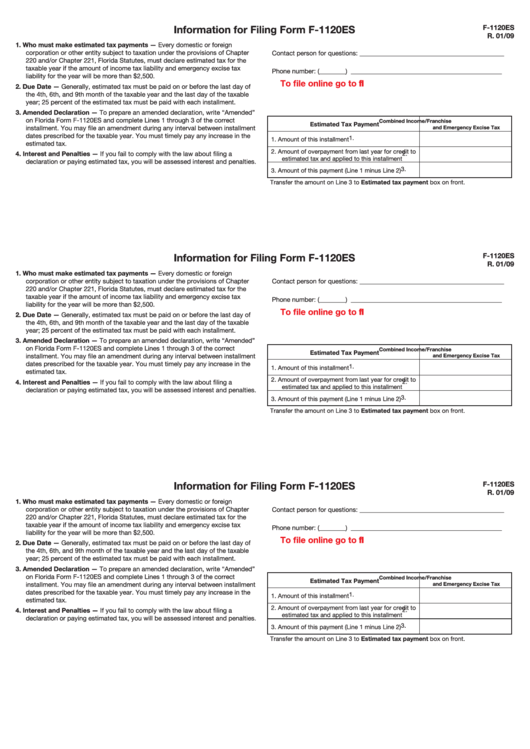

Information for Filing Form F-1120ES

F-1120ES

R. 01/09

1. Who must make estimated tax payments — Every domestic or foreign

corporation or other entity subject to taxation under the provisions of Chapter

Contact person for questions: ____________________________________________

220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the

taxable year if the amount of income tax liability and emergency excise tax

Phone number: (________) ______________________________________________

liability for the year will be more than $2,500.

To file online go to

2. Due Date — Generally, estimated tax must be paid on or before the last day of

the 4th, 6th, and 9th month of the taxable year and the last day of the taxable

year; 25 percent of the estimated tax must be paid with each installment.

3. Amended Declaration — To prepare an amended declaration, write “Amended”

on Florida Form F-1120ES and complete Lines 1 through 3 of the correct

Combined Income/Franchise

Estimated Tax Payment

installment. You may file an amendment during any interval between installment

and Emergency Excise Tax

dates prescribed for the taxable year. You must timely pay any increase in the

1.

1. Amount of this installment

estimated tax.

2. Amount of overpayment from last year for credit to

4. Interest and Penalties — If you fail to comply with the law about filing a

2.

estimated tax and applied to this installment

declaration or paying estimated tax, you will be assessed interest and penalties.

3.

3. Amount of this payment (Line 1 minus Line 2)

Transfer the amount on Line 3 to Estimated tax payment box on front.

Information for Filing Form F-1120ES

F-1120ES

R. 01/09

1. Who must make estimated tax payments — Every domestic or foreign

corporation or other entity subject to taxation under the provisions of Chapter

Contact person for questions: ____________________________________________

220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the

taxable year if the amount of income tax liability and emergency excise tax

Phone number: (________) ______________________________________________

liability for the year will be more than $2,500.

To file online go to

2. Due Date — Generally, estimated tax must be paid on or before the last day of

the 4th, 6th, and 9th month of the taxable year and the last day of the taxable

year; 25 percent of the estimated tax must be paid with each installment.

3. Amended Declaration — To prepare an amended declaration, write “Amended”

on Florida Form F-1120ES and complete Lines 1 through 3 of the correct

Combined Income/Franchise

Estimated Tax Payment

installment. You may file an amendment during any interval between installment

and Emergency Excise Tax

dates prescribed for the taxable year. You must timely pay any increase in the

1.

1. Amount of this installment

estimated tax.

2. Amount of overpayment from last year for credit to

4. Interest and Penalties — If you fail to comply with the law about filing a

2.

estimated tax and applied to this installment

declaration or paying estimated tax, you will be assessed interest and penalties.

3.

3. Amount of this payment (Line 1 minus Line 2)

Transfer the amount on Line 3 to Estimated tax payment box on front.

Information for Filing Form F-1120ES

F-1120ES

R. 01/09

1. Who must make estimated tax payments — Every domestic or foreign

corporation or other entity subject to taxation under the provisions of Chapter

Contact person for questions: ____________________________________________

220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the

taxable year if the amount of income tax liability and emergency excise tax

Phone number: (________) ______________________________________________

liability for the year will be more than $2,500.

To file online go to

2. Due Date — Generally, estimated tax must be paid on or before the last day of

the 4th, 6th, and 9th month of the taxable year and the last day of the taxable

year; 25 percent of the estimated tax must be paid with each installment.

3. Amended Declaration — To prepare an amended declaration, write “Amended”

on Florida Form F-1120ES and complete Lines 1 through 3 of the correct

Combined Income/Franchise

Estimated Tax Payment

installment. You may file an amendment during any interval between installment

and Emergency Excise Tax

dates prescribed for the taxable year. You must timely pay any increase in the

1.

1. Amount of this installment

estimated tax.

2. Amount of overpayment from last year for credit to

4. Interest and Penalties — If you fail to comply with the law about filing a

2.

estimated tax and applied to this installment

declaration or paying estimated tax, you will be assessed interest and penalties.

3.

3. Amount of this payment (Line 1 minus Line 2)

Transfer the amount on Line 3 to Estimated tax payment box on front.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1