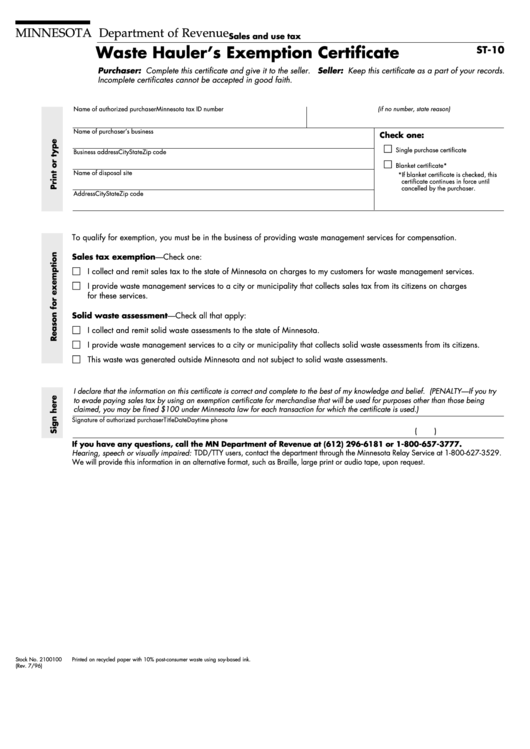

MINNESOTA Department of Revenue

Sales and use tax

Waste Hauler’s Exemption Certificate

ST-10

Purchaser: Complete this certificate and give it to the seller. Seller: Keep this certificate as a part of your records.

Incomplete certificates cannot be accepted in good faith.

Name of authorized purchaser

Minnesota tax ID number (if no number, state reason)

Name of purchaser’s business

Check one:

Single purchase certificate

Business address

City

State

Zip code

Blanket certificate*

Name of disposal site

*If blanket certificate is checked, this

certificate continues in force until

cancelled by the purchaser.

Address

City

State

Zip code

To qualify for exemption, you must be in the business of providing waste management services for compensation.

Sales tax exemption—Check one:

I collect and remit sales tax to the state of Minnesota on charges to my customers for waste management services.

I provide waste management services to a city or municipality that collects sales tax from its citizens on charges

for these services.

Solid waste assessment—Check all that apply:

I collect and remit solid waste assessments to the state of Minnesota.

I provide waste management services to a city or municipality that collects solid waste assessments from its citizens.

This waste was generated outside Minnesota and not subject to solid waste assessments.

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. (PENALTY—If you try

to evade paying sales tax by using an exemption certificate for merchandise that will be used for purposes other than those being

claimed, you may be fined $100 under Minnesota law for each transaction for which the certificate is used.)

Signature of authorized purchaser

Title

Date

Daytime phone

(

)

If you have any questions, call the MN Department of Revenue at (612) 296-6181 or 1-800-657-3777.

Hearing, speech or visually impaired: TDD/TTY users, contact the department through the Minnesota Relay Service at 1-800-627-3529.

We will provide this information in an alternative format, such as Braille, large print or audio tape, upon request.

Stock No. 2100100

Printed on recycled paper with 10% post-consumer waste using soy-based ink.

(Rev. 7/96)

1

1