Form S-206. S-016 Filling Instruction

ADVERTISEMENT

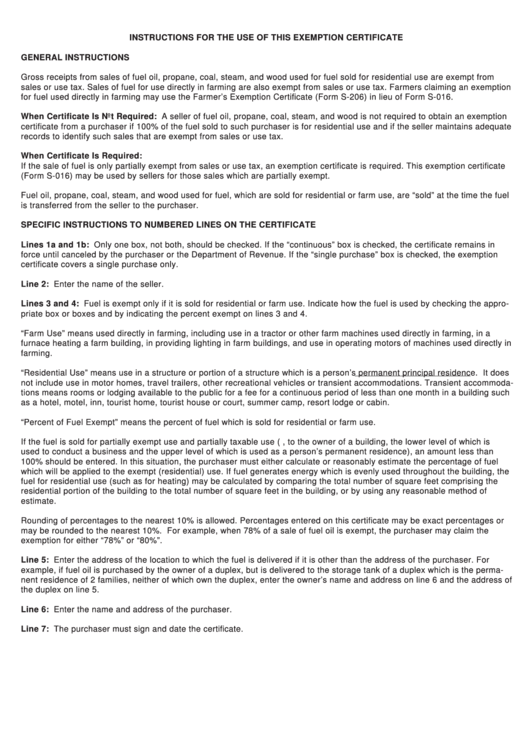

INSTRUCTIONS FOR THE USE OF THIS EXEMPTION CERTIFICATE

GENERAL INSTRUCTIONS

Gross receipts from sales of fuel oil, propane, coal, steam, and wood used for fuel sold for residential use are exempt from

sales or use tax. Sales of fuel for use directly in farming are also exempt from sales or use tax. Farmers claiming an exemption

for fuel used directly in farming may use the Farmer’s Exemption Certificate (Form S-206) in lieu of Form S-016.

When Certificate Is Not Required: A seller of fuel oil, propane, coal, steam, and wood is not required to obtain an exemption

certificate from a purchaser if 100% of the fuel sold to such purchaser is for residential use and if the seller maintains adequate

records to identify such sales that are exempt from sales or use tax.

When Certificate Is Required:

If the sale of fuel is only partially exempt from sales or use tax, an exemption certificate is required. This exemption certificate

(Form S-016) may be used by sellers for those sales which are partially exempt.

Fuel oil, propane, coal, steam, and wood used for fuel, which are sold for residential or farm use, are “sold” at the time the fuel

is transferred from the seller to the purchaser.

SPECIFIC INSTRUCTIONS TO NUMBERED LINES ON THE CERTIFICATE

Lines 1a and 1b: Only one box, not both, should be checked. If the “continuous” box is checked, the certificate remains in

force until canceled by the purchaser or the Department of Revenue. If the “single purchase” box is checked, the exemption

certificate covers a single purchase only.

Line 2: Enter the name of the seller.

Lines 3 and 4: Fuel is exempt only if it is sold for residential or farm use. Indicate how the fuel is used by checking the appro-

priate box or boxes and by indicating the percent exempt on lines 3 and 4.

“Farm Use” means used directly in farming, including use in a tractor or other farm machines used directly in farming, in a

furnace heating a farm building, in providing lighting in farm buildings, and use in operating motors of machines used directly in

farming.

“Residential Use” means use in a structure or portion of a structure which is a person’s permanent principal residence. It does

not include use in motor homes, travel trailers, other recreational vehicles or transient accommodations. Transient accommoda-

tions means rooms or lodging available to the public for a fee for a continuous period of less than one month in a building such

as a hotel, motel, inn, tourist home, tourist house or court, summer camp, resort lodge or cabin.

“Percent of Fuel Exempt” means the percent of fuel which is sold for residential or farm use.

If the fuel is sold for partially exempt use and partially taxable use (e.g., to the owner of a building, the lower level of which is

used to conduct a business and the upper level of which is used as a person’s permanent residence), an amount less than

100% should be entered. In this situation, the purchaser must either calculate or reasonably estimate the percentage of fuel

which will be applied to the exempt (residential) use. If fuel generates energy which is evenly used throughout the building, the

fuel for residential use (such as for heating) may be calculated by comparing the total number of square feet comprising the

residential portion of the building to the total number of square feet in the building, or by using any reasonable method of

estimate.

Rounding of percentages to the nearest 10% is allowed. Percentages entered on this certificate may be exact percentages or

may be rounded to the nearest 10%. For example, when 78% of a sale of fuel oil is exempt, the purchaser may claim the

exemption for either “78%” or “80%”.

Line 5: Enter the address of the location to which the fuel is delivered if it is other than the address of the purchaser. For

example, if fuel oil is purchased by the owner of a duplex, but is delivered to the storage tank of a duplex which is the perma-

nent residence of 2 families, neither of which own the duplex, enter the owner’s name and address on line 6 and the address of

the duplex on line 5.

Line 6: Enter the name and address of the purchaser.

Line 7: The purchaser must sign and date the certificate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1