Form M-45 - Agreement For Extension Of Limitation Period For Assessment, Levy, Collection Or Credit Of Fuel Tax Template - Department Of Taxation - State Of Hawaii

ADVERTISEMENT

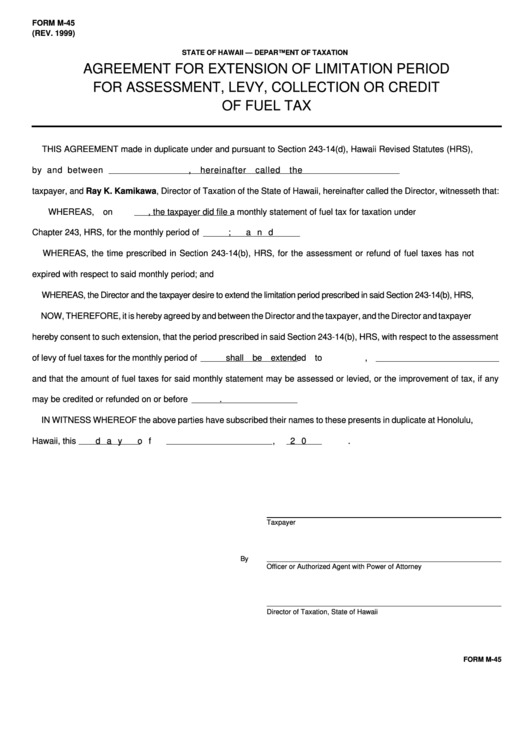

FORM M-45

(REV. 1999)

STATE OF HAWAII — DEPARTMENT OF TAXATION

AGREEMENT FOR EXTENSION OF LIMITATION PERIOD

FOR ASSESSMENT, LEVY, COLLECTION OR CREDIT

OF FUEL TAX

THIS AGREEMENT made in duplicate under and pursuant to Section 243-14(d), Hawaii Revised Statutes (HRS),

by and between

, hereinafter called the

taxpayer, and Ray K. Kamikawa, Director of Taxation of the State of Hawaii, hereinafter called the Director, witnesseth that:

WHEREAS, on

, the taxpayer did file a monthly statement of fuel tax for taxation under

Chapter 243, HRS, for the monthly period of

; and

WHEREAS, the time prescribed in Section 243-14(b), HRS, for the assessment or refund of fuel taxes has not

expired with respect to said monthly period; and

WHEREAS, the Director and the taxpayer desire to extend the limitation period prescribed in said Section 243-14(b), HRS,

NOW, THEREFORE, it is hereby agreed by and between the Director and the taxpayer, and the Director and taxpayer

hereby consent to such extension, that the period prescribed in said Section 243-14(b), HRS, with respect to the assessment

of levy of fuel taxes for the monthly period of

shall be extended to

,

and that the amount of fuel taxes for said monthly statement may be assessed or levied, or the improvement of tax, if any

may be credited or refunded on or before

.

IN WITNESS WHEREOF the above parties have subscribed their names to these presents in duplicate at Honolulu,

Hawaii, this

day of

, 20

.

Taxpayer

By

Officer or Authorized Agent with Power of Attorney

Director of Taxation, State of Hawaii

FORM M-45

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1